Acceptable expenses in selling a peace property to everyone - In the best of your experience, are the expenses defined in the attached contract…

Original publication date on the United States Real Estate Forum on Facebook:

2018-12-27T00:38:16+0000

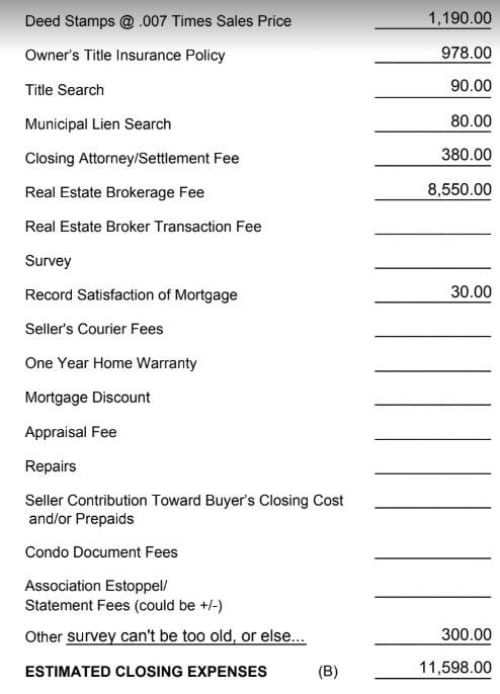

Common expenses in the sale of an asset

Hello everyone - in the best of your experience, are the expenses defined in the attached contract and on the sale expenses page standard - I am talking about expenses that apply to the seller of the property, not to the buyer of the property - there are expenses I have not seen before when selling properties. This is a property with financing.

Of course I will check with the Teitel company again, but I am always happy to test the wisdom of the masses.

Link to the original post on the United States Real Estate Forum on Facebook - Works on a desktop computer:

http://bit.ly/2CUv8KQ

The original responses to the post can be read at the bottom of the current post page on the site or in the link to a post on Facebook and of course you are invited to join the discussion

A valuable discussion..how much experience and wisdom there is in it… Thank you

The title of the buyer and seller is the same title?

The first section is unfamiliar to me.

The traditional closing costs are different in each state. In Florida, the seller pays for title work. (Please refer to your other Florida settlement closing statements.) You did not pay for the title insurance or search fee in any of your purchases as a buyer. The seller paid for it.)

Closing costs are negotiable, just as a buyer may ask you to pay his or her closing costs. You can always say no. Just like when a contract comes in on your house, you could put the title back on their site. Although, it would probably make the buyer very angry because it is the seller's responsibility to provide the buyer with a good marketable title and a title insurance policy. There is a policy the buyer is responsible for purchasing and it is called Simultaneous Issue, that policy protects any equity in the house as far as down payments etc. and is issued “simultaneously” with the owner's policy.

I know there was talk within the industry about making typical buyer / seller closing costs the same across the US, but it didn't happen.

As far as the survey, a buyer might accept the original survey. However, it is the title insurance company's call if they will accept it. The buyer's underwriter also has a say. If the survey is not too old and if it shows all additions (pools, Florida rooms etc. the title company might accept the original survey. The underwriter also has a say. The buyer will not pay for a survey on a house they don If a deal falls through, the seller owns the new survey on their home, because they still own the home. In the event something happens at the last minute, (the buyer dies, looses his job etc) The surveyor wants to get paid for his work.I believe that's why the seller pays for the survey.The survey is done while the seller still owns the house, not after closing. Now, with a cash sale, the buyer pays for a survey if he wants one. There is no loan underwriter involved with the sale either.

You may put any of your closing costs back on the buyer's side, your investment group right about that. But for them to say it's a "buyer's closing cost, they're wrong."

In my 22 years of real estate I only had 1 seller put the title back on the buyer's side and he was a builder. (I recall the buyer being furious, because the price of the house had already been verbally negotiated.)

Hello friends. Here's the realtor's response when I told him the expenses should apply to the buyer (the Florida property) - what do you think?

Owner title insurance It is not clear to me why this is about the seller and not about the buyer, unless the seller has promised it to his buyer as a benefit

Looks reasonable

Lior The Realestate FEE Naturally depends on the price of the property, everything else seems reasonable and fair, the Teitel takes on the work 380 $ maybe a bit expensive but not significant in my opinion

The first section is unfamiliar to me, but in our case the teitel falls on the seller. Everything else looked good. The lawyer is the Escobar that we share in equal share buying and selling. Sankhan commission falls on the seller and registration in the Land Registry also half and half.

There are some here I would expect to be on the buyer's side…