Advanced Social Investment - 10 properties for 10 investors under a joint LLC

Advanced Social Investment - 10 properties for 10 investors under a joint LLC

The original responses to the post can be read at the bottom of the current post page on the site or in the link to a post on Facebook and of course you are invited to join the discussion

With everyone who is just starting out - sorry. Something parallel can be established for beginners as well, or after the establishment of the advanced group, beginners will be able to enter as partners, for example by purchasing shares in LLC, and this of course with the consent of the LLC members.

I would be happy to hear suggestions for the following social investment:

How to invest -

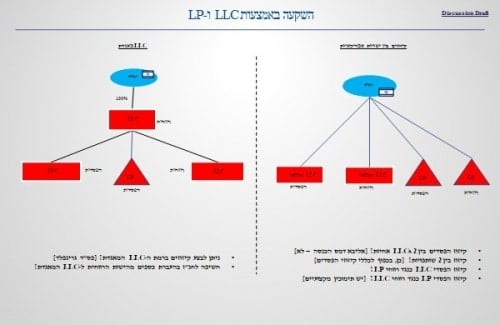

LLC is opened by an American entity. Each additional partner enters as an equal member at the LLC.

Who can enter:

1. Investors who have bought at least 2 properties in the US in a particular area over the last 5 years so that they are experts in the specific area and have gone through the entire purchase cycle.

2. They own at least 120 free money from the average price of the assets they specialize in.

3. The investor who wants to join the site must have an attractive property for investment in the specific market in which he specializes. Attractive property will be an asset that meets the rules accepted in this forum to locate a good property for investment. The founders of the LLC will analyze the transaction and decide whether the transaction is good enough to enter the investment group. Once an asset enters the investment pool, the asset locator joins the team of transaction analysts to approve the following assets that enter the LLC database.

4. When approving a property purchase for the LLC, a serious entry fee to the company is a deposit of 3000 dollars into an American bank account that will be opened to the benefit of the LLC.

5. The expenses of the LLC will be performed in a transparent manner from the bank account. All revenues will go under the same LLC

6. Every investor who enters the LLC must be an active partner in the management of the property he brought and in the management of the entire LLC. If the investor decides or becomes a passive partner - he must pay a management fee of $ 200 per month for the benefit of the company. These management fees will be distributed on a monthly basis among the other active managers.

7. The time interval for holding the LLC before realization is 10 years. An investor who wants to exit the LLC will take a neutral assessor at his expense to evaluate his property. The price of the property will be determined according to the appraisals and the rest of the investors will be granted the right to buy the property right into the LLC. It will not be possible to enter an investor in a place where it was issued if he did not meet the criteria for entering the LLC.

8. All investment assets will be below the price of 100 thousand dollars. Target rental 1 monthly percentage. If one of the assets invested by an investor is below this amount, he must complete the deposit to the LLC for 100 a thousand dollars, so that the investment of all the members will be the same. The seriousness fees are part of what 100 first thousand dollars.

9. Any change in the LLC's laws, in its character or in the investment objectives, shall be effected by voting. Although the holding percentage is identical among all, the voting rights will be 2 to 1 for the first three founders of the LLC, in order to preserve the original investment character for which the LLC was established.