How can I get credit without credit rating?

How can I get credit without credit rating?

Build credit from scratch

Question: We came here recently, and we can not get any credit because we do not have a credit history… What do we do?

Explains Eyal Tropan, a licensed mortgage broker and consultant in Washington, Oregon, California, and Texas, and an expert on business loans in dozens of other countries:

- For many people, building credit from scratch is like the paradox of the egg and the chicken: to be eligible for credit cards you need a good credit rating, but how can you create a rating without a credit card?

Here are some options to start building your new credit rating.

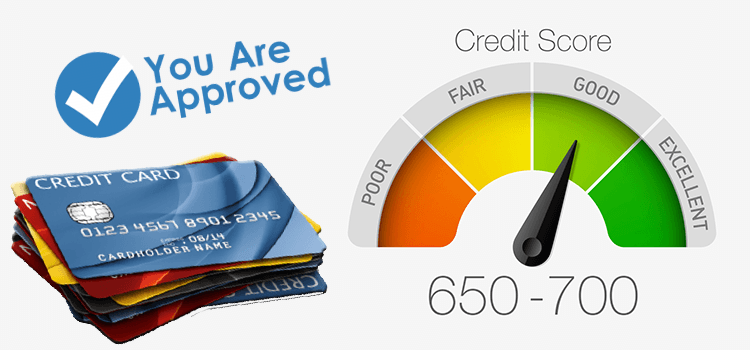

1. Build credit with credit card:

Ask for a student credit card or a secured credit card designed for people with little or no credit.

How does a secure credit card work?

Secure credit cards require a cash deposit (if you do not have a credit rating, you may be asked to deposit an amount equal to the maximum allowed balance, which is used as collateral if you are late in payments.) Such cards are not charged annually and make sure that the credit company reports to all three agencies Credit card use can help you build (or rebuild) your credit rating.

Student credit cards are primarily designed for young people who are starting their independent path. If you are affiliated with an academic institution, you may be able to obtain such a card without having to make a security deposit. These cards have the advantage that they may even come with promotional promotions as well as "rewards" (rewards). The potential downside is that they usually come with a lower credit line, and higher interest rates, so building credit can take a little longer.

Many stores offer branded credit cards. The purpose of these cards is only to help consumers save money in their favorite stores but also to give those with little or no credit an opportunity to prove that they can handle financial responsibility.

pay attention:

The interest on these cards is particularly high! If you carry a balance beyond the next payment date, you will also be charged interest on any new purchases from the billing date. If you pay the entire account balance by the required payment date at the end of each month, you will receive an interest rate charge on the same credit cycle.

2. Build credit with mom's friends:

Parents, family members, and sometimes even good friends may agree to "lend you" credit by adding you as an "authorized user" on one of their credit cards, or by signing as guarantors on your credit application.

Authorized user

Since it is not always easy to separate and charge you part of the monthly bill, this option is more suitable for close family members. The account holder is solely responsible for timely payment, and has no way to limit the amount of charges you add. If a relative or close friend is willing to take the risk, he or she will usually prefer to add you as authorized users on a cash-back or rewards card - so you have the opportunity to build your credit rating, while the cardholder can earn points or cash Back on every dollar you spend.

pay attention:

• Some credit cards may charge an annual fee for authorized users.

• The disadvantage (for cardholders, at least) is that they will be responsible for repaying the debts you accumulate, and if you do not control expenses or do not pay them in time, it will make them miss out on payment, accumulate debts and hurt your credit rating!

Shared signature

Whether you're looking for a credit card, a student loan, buying your first car, or even a mortgage application - family and close friends might consider signing a signature as Arabs. Adding another seal with an existing credit rating can increase your chances of getting good credit, which might otherwise not be available to you.

Unlike in the case of an authorized user, the liability for payment and timely payments apply to both of you. If you do not pay in time, and tonight will prove that you can do so, he can sue you in court.

3. Build credit without credit card

Student loans

College graduates who struggle to make timely payments on their student loans will be happy to know that at least they are building their credit history. But remember, any payment 30 days or more late will negate all the credit you have worked so hard for! It is advisable to set up automatic payments so that you do not forget.

Also, taking student loans may create more pressure on your financial position. The interest on these loans can be relatively high, some of the time you may reject part of the principal payments and even part of the interest. The more money you owe student loans, the less money you will have to repay to other lenders.

Car loans

Buying a car is another great way to build credit. Remember; You may have enough cash to buy the car and save money on interest - but it will not help you build your credit history.

This is one way that will allow even high school students to build a respectable credit history. However of course, it does not make sense to buy a car solely to build your credit, and it is advisable to think well and make sure that the chosen vehicle will meet your requirements and not create an unnecessary burden on your cash flow…

Mortgages

Homeowners can build credit by making timely payments. In contrast to other types of credit, the credit rating rarely falls in the first period after the loan is received, and because of its size, credit continues to be built at a relatively rapid rate - if there are no late payments.

renting

In some cases, credit can also be built by making timely payments of rent. If your landlord does not report your positive payment history (they'll usually only report if there's a problem), we recommend checking out online services such as RentTrack and PayYourRent.

Cellular payments and "alternative information"

Do not stop with your landlord… Ask the service companies (water, electricity, telephone, sewer, cellular, etc.) if they can report to the credit agencies on the payment ethics. Some lenders, as well as the Consumer Financial Protection Authority (CFPB) risks and benefits of using alternative data sources in deciding on loans.

Currently, reporting by these companies is optional, so it may help to ask them.

Personal loans

Personal loans (Peer To Peer or Payday Loans) may help low-income clients build credit. But often they bear high interest rates, especially (sometimes 50% or even over 100% per year!) For customers with bad credit or no credit at all. It is recommended to take extreme care in taking these loans.

Secured loans

A secured loan, also known as a credit card loan, works like a secured credit card. You pay a deposit in advance, which serves as collateral if you have not paid in time. Because of the manner in which the credit rating is calculated, it is highly recommended to issue both a credit card and a loan in installments (usually a car loan or a secured loan) to maximize the effect on credit construction.

4. How to act responsibly when building credit

The good news: If you're just beginning your journey to building your credit, you may have learned that you have more options than you thought. Getting credit card approval is just the first step. Here are some recommendations to keep in mind:

You do not have to pay interest!

Contrary to popular belief, you should not carry interest-bearing balances to build credit. If you only use credit cards, consider paying the entire balance each month to avoid interest charges.

Do not miss a single payment!

Late payments can stay on your credit reports for years (!) And ruin your credit. Do what you can to make any payment on time, even if you can afford only the minimum payment.

Do not waste too much!

While you may be excited to put your new credit card in use, try not to use more than 30% of your available credit. That is, if you have a credit limit of $ 1,000, try not to spend more than $ 300 at any given time. Maintaining a low credit utilization rate can help improve the overall health of your credit rating. Keep in mind: Until your monthly payment is not deducted from your account, your balance continues to increase. If the last account showed 30% utilization, do not use the card until the balance drops back to 0 $.

It's important to remember that you are not alone. According to data from the Consumer Protection Bureau (CFPB), it is estimated that 45 million Americans can not get a credit rating.

The Bottom Line

Unfortunately, it is easier to hurt the credit rating than to fix it. So look at a new beginning as an opportunity to create good habits and start your credit history on the right foot. We recommend that you sign up for a free account at CreditKarma.com or CreditSesame.com or to order 3 reports per year (one from each credit bureau) at AnnualCreditReport.com (this option should also work with ITIN, although it does not give a credit rating. Credit A paid service must be used by one of the credit reporting agencies.

If you have any further questions on issues related to real estate financing and mortgages, I would love to post answers in the forum.

(Note: Membership

American Pacific Mortgage ANDOR My Property Funding, LLC

Are not credit repair companies, this information is intended for general knowledge. We are not authorized to amend credit, and Eyal Trofen is not authorized as a credit repair consultant

The original responses to the post can be read at the bottom of the current post page on the site or in the link to a post on Facebook and of course you are invited to join the discussion

Thank you.

Daniela Weissman

Excellent post

Excellent post!

a question

Can foreigners build a credit rating?

This refers to the owner of the LLC

By the way even those who have a credit card with a low frame can actually pay through the credit card company's website for the debt it has and then the framework is renewable at that moment

Achla Post.

In case there is a credit card to the business on who reports the credit rating? On the owner of the business or on the business itself?

Excellent post!

I do not know I started from scratch and today I'm on 800 credit I started from nothing to all the smart guys

Thanks Eyal

Liran Rotter

Munir Barakat

An Israeli start-up that came to address the need for relocation to the United States on credit cards

https://www.creditstacks.com/