How to defer payment of taxes on a house you sold? 1031 Exchange

How to defer payment of taxes on a house you sold? 1031 Exchange

In the American real estate economy it is a locomotive that knows how to lead the country it is booming, and also to take it down that it is collapsing.

However, the amount of Congress members holding real estate remains high, as it has been for the past 100 years. And so, beyond my and many people's belief that investing in long-term real estate is a right investment, there are many benefits that come directly to us from the US Legislature for all investors in the field.

US authorities benefit in many ways, if those who decide to put their capital in a yielding property. Whether it's buying a store, a mall or a house.

The tax issue is a complex matter, and most people, including American residents, do not really understand the benefits that come with purchasing and holding real estate.

One is called 1031 substitution

Replacement number 1031 is, as it is, a replacement of one real estate asset, the other.

That is, as long as you stand in the definitions, there is no need to pay tax on the profit from the sale of the house.

In large, swap 1031 says that as long as you have not "cashed out" of the transaction, but have taken the full amount and invested it in a "similar" property, through a company that manages you the money (called 1031 Accommodation) you will not have to pay any profit. (Similar property - is a broad definition, which may include the replacement of a building in a building, or a building on a farm, but we will not enter it.)

If we purchased a house with a total investment of $ 100,000. And after 4 years, the property value doubled and reached $ 200,000. And we decided to sell the property.

If we pull the profit out of pocket, we will have to pay the tax authorities in the area 20% of the profit. That means $ 20 will go directly from our pocket to the US government.

However, if we decide to take the money we earned from the sale and reinvest it in a similar real estate investment of the same amount (since any amount we do not invest in the next asset will be taxed as capital gain), we will be completely exempt from paying profit tax.

There are different ways 4 do the paging:

1) instant exchange where one property buyers at the same time are sold to the other property.

2) Replacement rejected - which gives a period of 6 months to sell one property, and buy a second property.

3) Swap Reverse Reverse - which is where buyers first property and then sell the first property.

4), which enables the purchase of a cheaper asset from the property sold, and uses the profits to renovate it.

This exchange can be done indefinitely, and as long as it meets the IRS standards, you will be exempt from tax until you decide to sell the property and pay only the difference between the purchase amount and the sale amount.

The original responses to the post can be read here below, and of course you are invited to join the discussion!

- Thank you!

Is not even a non-American resident entitled to this benefit? Are there additional criteria that must be met (except for the exchange of property in a similar property)? - Achla Post

- All is true, but it should be noted that the tax base for the purpose of calculating the taxable profit at the time of realization will be based on the first asset you sold and future depreciation expenses will also be on the basis of the first asset you sold.

- An important point if I was not honest.

Thanking her

Thanks for adding Elad Pedy - Hey, there are some inaccuracies. And especially in a post written to the Israeli public, it is mandatory to emphasize them. First, the exchange in question is called in Israel for the transfer of assets.

The transfer of assets in both the US and Israel does not exempt tax, this term is not true, but there is a deferred tax liability. Meaning that the tax liability is deferred until the last asset in the chain is realized or the taxpayer will have to pay tax on all the profits accrued to him on the way.

Second, why does the exchange of assets not constitute a real benefit for the ordinary Israeli who invests? Since in Israel there is no tax deferral due to the transfer of real estate assets (recognized in the law that the exchange of capital gains on movable property but not on land). And therefore even if a change is made in the US and we receive a tax rebate, we will have to pay the tax in Israel anyway, so that in fact we did not earn anything. Since capital gains tax in Israel is higher, in most cases, especially those who are involved in real estate activities (then tax rates are higher), we will pay and pay a high tax in Israel.

Thus, one US state recognized our tax deferral, but Israel did not recognize it and was required to pay the entire tax.

So, in fact, it's not practical.

I will note that there are ways to make a change of assets in the US without paying capital gains tax in Israel, and only if the investment is made through an American company that is not transparent for tax purposes. As most members here tend to invest.

In other words, only a company that pays double tax, corporate tax, and a dividend tax on the distribution of profits, will be able to carry out assets that will be recognized in the US and in Israel. But this is, of course, a form of investment that is not suitable for all investors, especially the small or medium, but for the larger players who, despite the double taxation, still have to act in this way. - Thank you very much for the detailed response 🙂

Is it possible to conclude from what you are saying here that if an Israeli citizen is the center of his life in Israel,

The only way he could enjoy the benefit

This is by opening up a separate legal entity that is not

LLC

For example

C-CorpMaor Stav Buchnick - Ari Frank

- Nir, also LLC can be “not transparent”. Know that there is a chance that you will pay double the tax. For the first time in Israel in the tax year of the sale and once again in the end of the investment in the United States because Arav does not recognize the tax paid in Israel in a previous tax year. It is very dangerous for the pocket to do such things without escorting American and Israeli CPAs.

- Just a spicy addition to writing: Doesn't have to swap real estate… that is, can sell a property and buy a collectible (with a certificate) or even create a Picasso art ... and not pay tax by rolling the deal. In Florida, all treatment is performed by specialized companies that specialize in the subject matter and cost of the "bag" is around $ 1000. Just for general knowledge.

- Very interesting, but if I understand correctly from the reactions, in the end it is irrelevant to most investors because in Israel will be required to pay the tax on the sale?

If there is an accountant in the group, it may be worth addressing the issue. - Michael Lerman

- As written in detail in previous responses,

Israel does not recognize the exchange of assets - 1031 Exchange

And therefore the Israeli tax authorities will require those who do so to tax the capital gains generated as a result of this action.

Therefore, it is very important, if you still want to do so, to take the accompaniment of the spirit of Israel and the United States. - Pretty

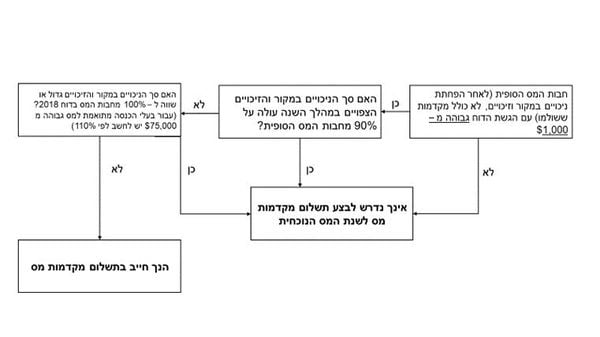

- You should be very careful in executing 1031 because you must meet very strict criteria such as: finding an alternative property within a specified tax days. Closing within a specified number of days. Any deviation from this will cancel the 1031.

Also, you can not sell under a certain name and buy under a different name, meaning if the property is registered in Teitel for my name I can not buy on an LLC that shakes, it must be exactly under the same name that was sold.

And there are still other details that must be clarified before the 1031 transaction. - It is amazing to me that so many people here are willing to accompany an accountant. I wonder when an accountant has become a lawyer with expertise in real estate taxation in Israel. As it is someone who is both a spirit and another and also a real estate tax expert then on the kipak. But just pointing to the spirit ... that's not the function.

There are people who are qualified lawyers with many years of experience working with the tax authorities in the service of investors who help them to conduct themselves properly with authorities and save a lot of taxes by various means.

When I go to examine the establishment of a company for the purpose of investment in the US, I always use my tax advisor with regard to the form of incorporation, determination of the manner of activity and appropriate tax tracks.

There are loads of legal issues here that affect how taxation works - so in my opinion, it is best to consult a lawyer first and secondly to understand real estate taxation.

- Suggesting that you edit the post again.

There is no such thing - how not to pay taxes on a house you sold ...

This is deception !!!

Maor Stav Buchnick is absolutely right! Offers everyone to read her response.

That the transfer of assets is not relevant and there is no such thing as tax exemption and deferment of the tax obligation is not relevant in Israel !!! - Thanks a lot for a quality post?

- very interesting.

Thank you?? - I'll add just one point: For US residents using this tool, the ultimate benefit is in the event of the owner's death, so heirs can get the latest in the chain, upgraded to current value, with no tax liability on all profits since the original purchase.

I'm not an accountant, lawyer or tax advisor, so please consult with whoever he is. - Are these laws valid for the sale of property in Israel and the purchase of another in the US?

- Liran Dandeker has broken the rules of the group and posted a public comment with an external link. We have to block you from the group. Friends - Thank you for reporting and helping us maintain this forum as a sterile and pleasant learning environment.

- Liran Rotter

- Thanks for the post! Is this relevant only to the house where you live?

- Relevant to any investment Shiri Amoray

Thanks for the post! Is this relevant only to the house where you live?

Liran Rotter

Liran Dandeker has broken the rules of the group and posted a public comment with an external link. We have to block you from the group. Friends - Thank you for reporting and helping us maintain this forum as a sterile and pleasant learning environment.

Are these laws valid for the sale of property in Israel and the purchase of another in the US?

I'll add just one point: For US residents using this tool, the ultimate benefit is in the event of the owner's death, so heirs can get the latest in the chain, upgraded to current value, with no tax liability on all profits since the original purchase.

I'm not an accountant, lawyer or tax advisor, so please consult with whoever he is.

Thanks!

very interesting.

Thank you??

Thanks a lot for a quality post?

Suggesting that you edit the post again.

There is no such thing - how not to pay taxes on a house you sold ...

This is deception !!!

Maor Stav Buchnick is absolutely right! Offers everyone to read her response.

That the transfer of assets is not relevant and there is no such thing as tax exemption and deferment of the tax obligation is not relevant in Israel !!!

It's amazing to me that so many people here are going to accompany an accountant. I wonder since when an accountant became a lawyer with expertise in real estate taxation in Israel.

As long as it's someone who is both a spirit and more and also a real estate taxation expert then on the kippak. But just referring to the spirit… this is not the function.

There are people who are qualified lawyers with many years of experience working with the tax authorities in the service of investors who help them to conduct themselves correctly with the authorities and also save a lot on taxes through various means.

When I go to examine the establishment of a company for the purpose of investment in the US, I always use my tax advisor with regard to the form of incorporation, determination of the manner of activity and appropriate tax tracks.

There are loads of legal issues here that affect how taxation works - so in my opinion, it is best to consult a lawyer first and secondly to understand real estate taxation.

You should be very careful in executing 1031 because you must meet very strict criteria such as: finding an alternative property within a specified tax days. Closing within a specified number of days. Any deviation from this will cancel the 1031.

Also, you can not sell under a certain name and buy under a different name, meaning if the property is registered in Teitel for my name I can not buy on an LLC that shakes, it must be exactly under the same name that was sold.

And there are still other details that must be clarified before the 1031 transaction.

Pretty

As written in detail in previous responses,

Israel does not recognize the exchange of assets - 1031 Exchange

And therefore the Israeli tax authorities will require those who do so to tax the capital gains generated as a result of this action.

Therefore, it is very important, if you still want to do so, to take the accompaniment of the spirit of Israel and the United States.

Michael Lerman

Very interesting, but if I understand correctly from the reactions, in the end it is irrelevant to most investors because in Israel will be required to pay the tax on the sale?

If there is an accountant in the group, it may be worth addressing the issue.

Just a spicy addition to writing: Doesn't have to swap real estate… that is, can sell a property and buy a collectible (with a certificate) or even create a Picasso art ... and not pay tax by rolling the deal. In Florida, all treatment is performed by specialized companies that specialize in the subject matter and cost of the "bag" is around $ 1000. Just for general knowledge.

Nir, also LLC can be “not transparent”. Know that there is a chance that you will pay double the tax. For the first time in Israel in the tax year of the sale and once again in the end of the investment in the United States because Arav does not recognize the tax paid in Israel in a previous tax year. It is very dangerous for the pocket to do such things without escorting American and Israeli CPAs.

Ari Frank

Thank you very much for the detailed response 🙂

Is it possible to conclude from what you are saying here that if an Israeli citizen is the center of his life in Israel,

The only way he could enjoy the benefit

This is by opening up a separate legal entity that is not

LLC

For example

C-Corp

Maor Stav Buchnick

Hey, there are some inaccuracies. And especially in a post written to the Israeli public, it is mandatory to emphasize them. First, the exchange in question is called in Israel for the transfer of assets.

There is no tax exemption on the exchange of assets both in the US and in Israel, this term is not correct, but there is a postponement of the tax liability. That is, the tax liability is deferred until the last asset in the chain is realized or then the taxpayer will have to pay tax on all the profits he has accumulated along the way.

Second, why does the exchange of assets not constitute a real benefit for the ordinary Israeli who invests? Since in Israel there is no tax deferral due to the transfer of real estate assets (recognized in the law that the exchange of capital gains on movable property but not on land). And therefore even if a change is made in the US and we receive a tax rebate, we will have to pay the tax in Israel anyway, so that in fact we did not earn anything. Since capital gains tax in Israel is higher, in most cases, especially those who are involved in real estate activities (then tax rates are higher), we will pay and pay a high tax in Israel.

Thus, one US state recognized our tax deferral, but Israel did not recognize it and was required to pay the entire tax.

So, in fact, it's not practical.

I will note that there are ways to make a change of assets in the US without paying capital gains tax in Israel, and only if the investment is made through an American company that is not transparent for tax purposes. As most members here tend to invest.

In other words, only a company that pays double tax, corporate tax, and a dividend tax on the distribution of profits, will be able to carry out assets that will be recognized in the US and in Israel. But this is, of course, a form of investment that is not suitable for all investors, especially the small or medium, but for the larger players who, despite the double taxation, still have to act in this way.

An important point if I was not honest.

Thanking her

Thanks for the addition Elad Pedy

It is an interesting and interesting point that, to be honest, I did not know.

Thanks for the addition Elad Pedy

All is true, but it should be noted that the tax base for the purpose of calculating the taxable profit at the time of realization will be based on the first asset you sold and future depreciation expenses will also be on the basis of the first asset you sold.

All is true, but it should be noted that the tax base for the purpose of calculating the taxable profit at the time of realization will be based on the first asset you sold and future depreciation expenses will also be on the basis of the first asset you sold.

Achla Post

Achla Post

Thank you!

Is not even a non-American resident entitled to this benefit? Are there additional criteria that must be met (except for the exchange of property in a similar property)?

Thank you!

Is not even a non-American resident entitled to this benefit? Are there additional criteria that must be met (except for the exchange of property in a similar property)?