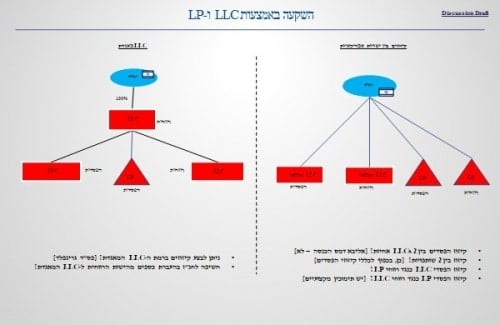

Taxation question: 2 investors. One from Israel and one from the USA open an LLC together. Entering a flip deal…

Tax question:

2 investors. One in Israel and one in the US are opening an LLC together. Enter into a 4 month flip deal. What is important to know in terms of taxation and reporting?

The original responses to the post can be read at the bottom of the current post page on the site or in the link to a post on Facebook and of course you are invited to join the discussion

Hey dear Albert

This is a partnership for tax purposes when one of the partners is a foreign resident

Assuming that this is the first asset, it will be classified as a capital gain (although it is possible to claim regular income) and each partner will be taxed according to its share.

It is important to remember that the partnership is subject to withholding tax to the foreign partner

Everyone pays according to his tax bracket, but the Israeli must deduct tax at source

At the end of the year, a report must be submitted to the company, as well as a personal report for each