I would be happy to raise a question that is not exactly an investment in real estate but limits in some way to a partnership in…

I would be happy to raise a question that is not exactly a real estate investment but somewhat restrictive to a real estate partnership

?

About question:

Considering investing in a safe room, the investment is basically an owner's loan when the fund is held within 6 years + 4 percent per year (3 first interest only and then principal plus interest). After the fund is returned, I remain with shares in the company and the yield continues to bind according to the room occupancy (amount of cash leased).

?.

The parallel is basically a real estate partnership model: enjoying the return of your relative share but you have no control over the decisions made in the company and not realization etc…

In a world like today that the variety of investments is so great I would love to hear your impression of an investment that is a little out of the box ??

Igal Vainrov I sent reference information from another source for this investment.

I have a personal history in banking .. Banks are very scared of this issue because of regulation, are burdensome and always ask too many questions what the client likes to tell, the bank is not allowed to hide money from the authorities and is obliged to make statements that everything is tax paid and documents need while the private market is still very gray but the future is not Obviously, as long as the authorities do not enforce the issue of money laundering and also report on private safes the area in my opinion is expected to prosper, but of course it is not forever, and there is already an accurate record of all dealers and license applicants in these areas

I would invest in real estate, which also brings in more than 4% a year, and not in the first-time product model I hear about, and whose future is unknown. The house always stays yours and can be sold

Beni Cahana

You will request an accountant account of the safes in Tel Aviv and also speak to other investors from Tel Aviv who will request their income report. By the way, on the Internet, there seem to be some companies that are dealing with this.

https://www.fundit.co.il/project/5849?utm_source=facebook&utm_medium=post&utm_campaign=30&fbclid=IwAR2WKABI09o1UKNPGam70tUEMZ_ARGAHShASfUymPOWzZLBOrZeuRVqX1c0

This is a link to the CEO. (I have nothing to do with the company, I'm just interested). In my humble opinion if the model succeeds then there is an opportunity here to enjoy a passive income after 6 years when the 4 annual interest rate + interest rate is returned.

If you believe that digital currencies will rise gradually, then digital safes will rise respectively at the expense of regular safes. Then it's a bad investment.

In any case, you have a reliable way of analyzing current supply and demand in the bargain area, whatever the price trend in recent years. This is a market you are unfamiliar with, you need to research the subject before you have a decision tool. Are you built for that?

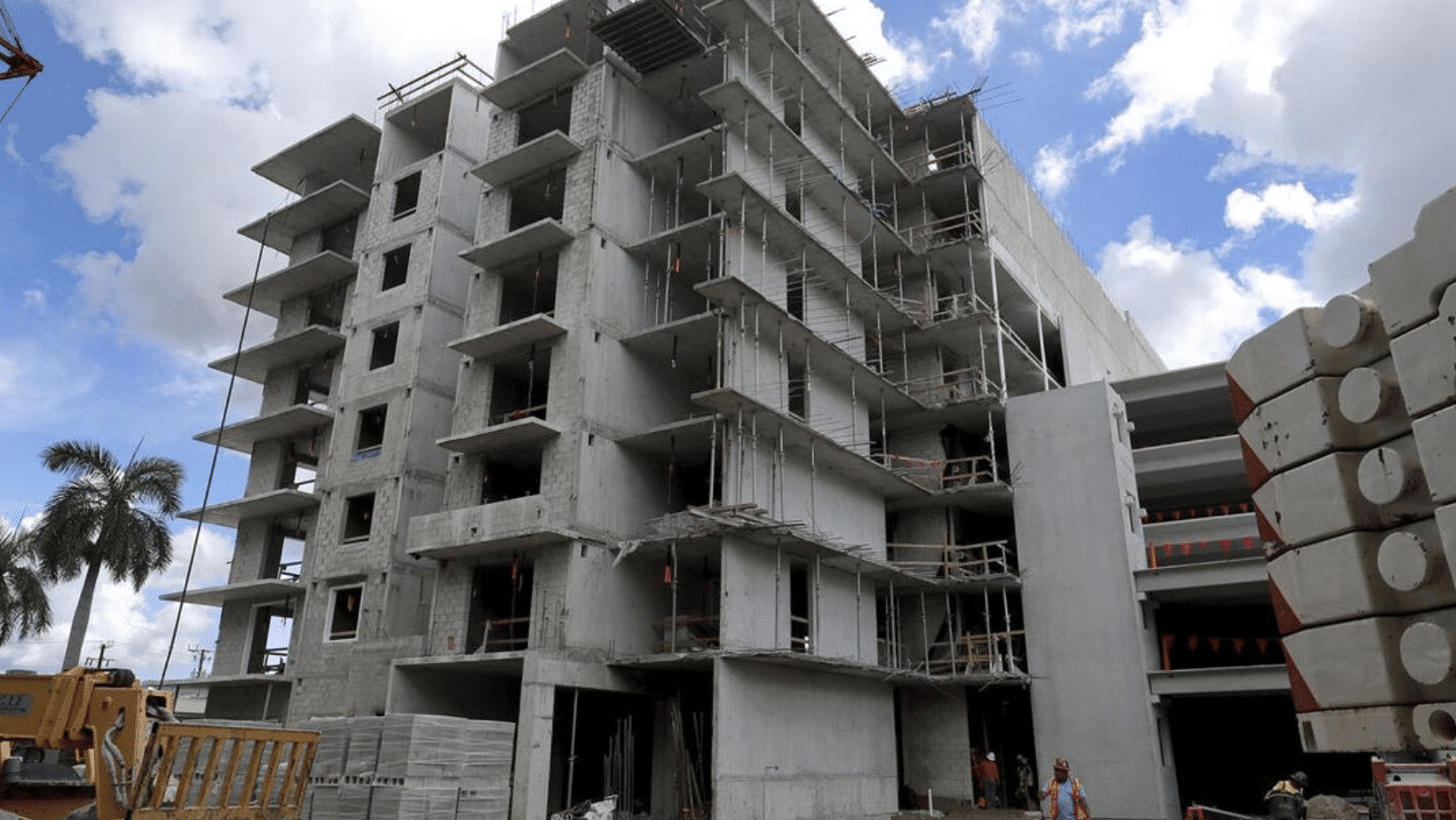

Investment is primarily for growth. The company has a safe room in Tel Aviv since 2016 and is occupying over 90 percent and opening another room in Jerusalem.

The trend in banks is to close their rooms (some are already closed). Demand for existing safes, ie demand exceeds supply - banks have long queues.

As for yield. In 6 first years it is 4%. Then when all the loan is repaid, investors start receiving a dividend that can reach 40% per year if everything goes according to business plan.

As for limiting the use of cash, it is difficult to know. Unknown % of people's use of only cash storage - it's discreet. Can store everything: cash, documents, wills, jewelry, valuables and much more.

I saw the ad. For the first five years it is 4 percentage and year 6 they estimate 30 percentage dividend yield. This is also the disadvantage of the actual return on investment coming after far too long and you will know what will be in 5 years. Maybe all the money will be virtual by then

I wouldn't go into it for 4 percent a year

The question of why investing in a high risk investment that you have no knowledge of in the field for a 4 rate of return.

The business model is understandable. What do you know about the field? Does he have a demand? What is the advantage of this company for banks' safes? Will the trend of cash payment restriction affect the demand for safes? Is the money raised in this model meant for ongoing growth or management?