Are you a 5% type? 10%? or 15%? One of the wonders of compound interest in real estate investments……..

Are you a 5% type? 10%? Or 15%?

The wonders of compound interest in real estate investments… .. (Sorry - this is a bit long)

Suppose we have already realized the benefits of investing in real estate, we have accumulated modest initial equity and we have come to the decision: we are looking for an investment property!

But - is the nature of the property we are looking for suited to our goals, character and risk profile?

Will we focus on an investment that will yield a return of 5%, 10% or 15%?

What's the right thing for us?

5% investment -

What is an asset of 5%? It is a high yielding asset, say in Israel, a very low risk investment, an area where prices are stable, there is a constant demand for rent and a high probability that we will rent the property continuously.

We are not looking for special adventures, are interested in owning a property for a long period, are not looking to sell and then buy again, but simply "sit on the property".

Suppose our equity is NIS 200,000. If the nature of this investment is right for us, we can definitely take out a loan (mortgage) and purchase a property at prices of NIS 400-750, which will meet these criteria, and then, such an asset can produce us a return of About 5% on equity.

If we hold on to this property for many years - our amount of money will grow and grow and grow….

The principle of compound interest is simple: in the first year we will earn 5% (ie 10,000 NIS), and now our amount of capital is equivalent to 210,000 NIS. Next year - we will earn 5% again (this time NIS 10,500) and the amount of money will increase even more.

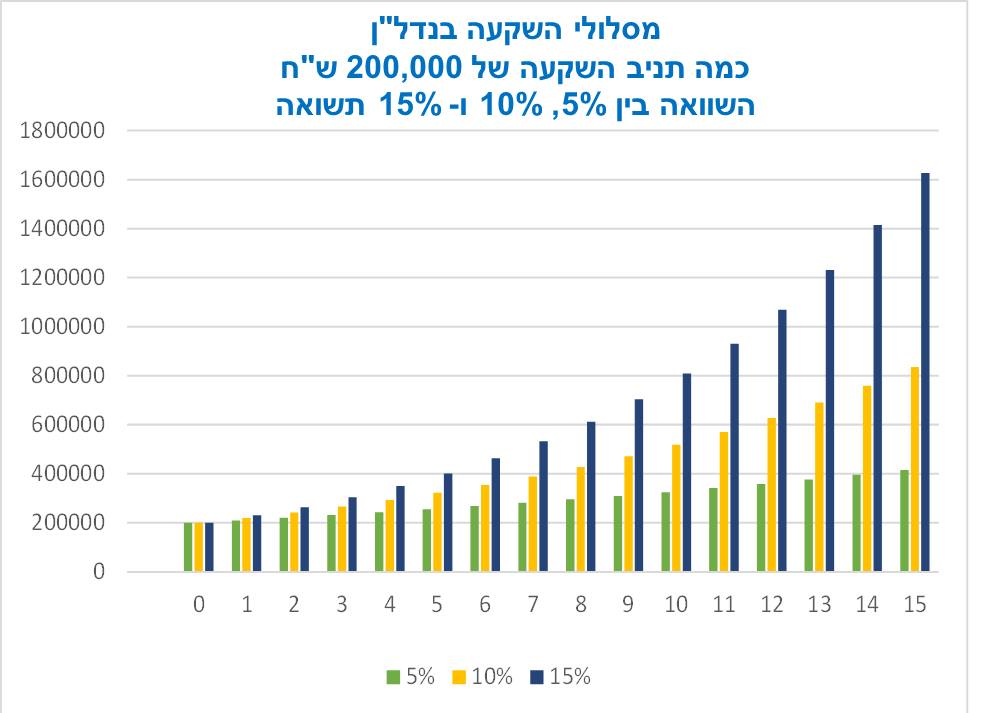

If we hold this property for 15 years, and assume that its value in the market does not increase at all (well, that really was not the case in the last decade), our amount of money will reach NIS 415,000!

This is the basic principle of compound interest, in which we earned 215 NIS in this track within 15 years.

10% investment -

What is a 10% asset? There are all kinds of real estate investments that can provide a 10% return. Before we continue, let's agree: a 10% investment will generally have higher risk characteristics than a 5% investment.

For an investment of 10%, I would call medium-low risk investment.

For the sake of explanation, I will choose the following investment: a yielding asset, one that gives a current return of 4% -6%, but in addition - the value of the asset increases by a few percent each year, so that the aggregate return on equity is at least 10% (but there can be even more) .

True, we cannot know for sure that the value of the property will rise. But we can exercise sound judgment, consult with experts, learn for ourselves, etc. - and significantly increase the likelihood that the value of the property will actually rise.

To be on a 10% track record (and stay there for years) - we need to be more vigilant and more active. In the current era - to sit on a 10% investment I highly recommend being exposed to real estate investments abroad as well.

Even if we have chosen a property in a certain location, whose value has risen for a number of years - it is likely that after a certain price increase - we will want to sell the property and then purchase another property in another location, which can provide a better value increase.

A 10% investor, if he chooses income-producing real estate - it is important that he be active and perform "attitude improvement" once every few years.

And what will a 10% investor get if he invests the same NIS 200,000, at the end of 15 years?

This is crazy, but due to the principle of compound interest - such an investor will receive at the end of 15 years a sum of 835,000 NIS !! About 4 times the amount of the investment.

This investment gave us a profit of 635,000 NIS this time!

Although the return on this investment is only 2 times the previous scenario, the profit we achieved here is 3 times higher than the previous scenario. The wonders of compound interest….

15% investment -

Here, too, there are various investments that give a return of about 15%. And again, these would mean that you have to spend for these processes, and they have to pay 15%.

How to get into 15% track?

This time I will take an example of an improvement project. Suppose this is a group project led by an entrepreneur, in which each investor contributes an amount of NIS 200,000, the project lasts two years and in the end - the investors and the entrepreneur share the profit.

There are many entrepreneurs who offer to join improvement projects (usually abroad) that provide a return that ranges from 10% to 20% per year.

Do you have to join the improvement project to invest in the 15% track? Definately not!

Income-producing real estate investment in Israel in the years 2008-2018, investment-yielding real estate investment in the United States in the years 2010-2014, or investment-making real estate investments in Spain, Portugal, Greece, Hungary and more - have given an aggregate return of 15% or more in recent years.

The place does not allow here to analyze the differences between the types of investment that can bring us a return of 15%, but let's agree that there must be more than one way to do this.

If we take those 200 NIS - and invest them again and again (along with the profit they have accumulated) - with an additional investment of 15%, what will happen at the end of the period (15 years) - is an accumulation of an amount of 1,627,000 NIS… ..

The interest rate is about 4 higher than the first example but the profit is about 7 higher !!

The Wonders of the Interest Rate… ..

The picture here, shows the difference in the amount of money we have accumulated over 15 years in these 3 tracks.

So what kind of guys are you? Of 5%, 10% or 15%?

That's not a fair question. We'd all love to be on the 15% track always. But the risk factor associated with investments that give 15% a return every year should not be separated.

My rule says - I try to reach a situation where my investment portfolio is at least on average 10%.

how do I do it?

Some (very small) of my investments are very low-yielding assets (say, about 5% yield).

A significant part of my investments - they are investments of 10% - income-producing assets with a substantial potential for increase in value. The truth - in practice, even in this track I get a lot more than 10% a year - simply because I choose areas where property prices go up significantly and I also replace them every few years.

Another significant part of my investments are investments of 15% and above - these are improvement projects and entrepreneurship. They have a slightly higher risk, but their profit potential is very high, respectively.

In this way, in which my entire portfolio is invested in various channels giving an average return of over 10%.

In conclusion

There is no such thing as a "best investment". Each of us has the investment that suits him better. Everyone has to choose in which mix his investment portfolio will be built.

Not all investments need to be real estate investments. Most of us invest large sums of money (the provident and pension funds) in channels related to the capital market, and usually give an average return of about 5% per year.

Therefore, in my real estate investments - I mainly concentrate on investments in the 10% and 15% tracks.

The most important principle is: Your money should work for you! non stop!

It should be invested in 5% or 10% or 15% channels, and work over and over again, earning you profits based on the interest rate principle.

This is the best way in my opinion, to build a real estate based pension.

Successfully,

Link to the original post on Facebook - Works on a desktop computer (To view the post must be members approved for the forum)

Sorry but your post is wrong and misleading,

How exactly does a property make interest rates? This is not a loan

The property is rented to a tenant who pays $ 10,000 a year

He doesn't pay 10,500 in the second year just because you seem to have earned it. Not to mention that everything goes back to the bank and it's with interest rates.

2. Show me one private property with 5% interest in the country.

3. You will not borrow more than 50%, so you can buy for 200k if it is an investment property.

4. Does not know assets in 400k except fourth floor without elevator in Arad.

5. In the US, there are no assets with a net of 10 either.

According to your millionth post I will have 8 million in 15 years.

Walla to Robert Kiyosaki had no such return

Maybe help him

Ben Lerner Gal Hindi

Great post, thanks so much for the investment

1. In the example of the assets that generate 5% annual, what does the interest rate interest come from in case the asset does not exceed its value? After all, you do not reinvest the rent in the apartment.

2. Net return of only 5% of rent is not as trivial as shown, given all the deductions and actual expenses.

Really good post!

Thank you Yair, you wrote a beautiful and very interesting!

Thanks Yair!

Excellent post. What is problematic for me, and I would love to explain, is how these returns (at least in Israel) come about when the purchase tax on a second apartment or higher is 8% and on commercial 6% (already significantly beating profit) and of course the sales tax.

Excellent post ?? ?

Agree with every word.