Is The Housing Market About To CRASH? | HOUSING CRISIS

So is the real estate market in the United States going to collapse?

Is The Housing Market About To CRASH? | HOUSING CRISIS

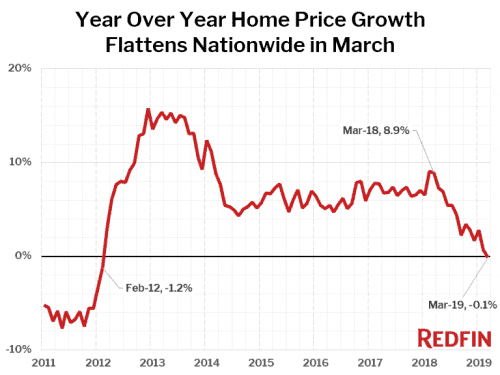

Is The Housing Market About To Crash? Housing CRISIS coming to the USA... Between mid-2006 and early 2009, home prices dropped by 35% in the first nationwide...

Link to the original post on Facebook - Works on a desktop computer (To view the post must be members approved for the forum)

I write about Florida from personal experience and from the fact that I have been "living my people" here for 20 years: there is a lot of psychology that is difficult for most readers here to understand whether out of ignorance of the market or lack of understanding of how the system works - and I will explain: about 10 days ago A psychologist who talked about "market behavior in stressful situations" and did not have and has no connection to real estate but (!) His line of thought leads those who deal in real estate (again - in Florida) to different and more positive thoughts and conclusions: (I will add that I am a real estate agent In the largest private company in the US), currently there is a decrease of about 25% in the real estate market here, the decrease is due to the closure and lack of knowledge to behave that was here last month, only last Wednesday we did OPEN HOUSE in the middle of the day and within two hours 6 agents with customers (everything is documented on my appeasement page) This means that the private market “lives kicking and breathing”… Where there will be a problem, not just a problem but a serious problem! - In the skyscrapers scattered along the beaches of South Florida between Fort Lauderdale and Miami and between Marco Island and Naples… where I think there is going to be a "catastrophe" and why: a month and a half people in the kind of quarantine / house arrest, live in the most magnificent tower You have the option to use the building services (pool / gym / private beach) because everything is closed… and hussi, on it the natural fear of not bumping into someone in the elevator that you go down and are afraid to press the buttons… Add the absurdly high management fees - connection of all These bring you to something (in the government of Israel) like "a detention cell in the middle of the Akirov Tower"…. Already now I feel a change in the market of a growing trend of demand for private homes from people (especially with children) who are looking to move to a private home and preferably with a swimming pool… I want to say that the private real estate market is going to undergo a change in consumer perception. Add to that the rental market where there is constant talk that "apartment owners will suffer a fatal blow" so in the meantime the Miami district is going to pay a quarter for the coming month to thousands of property owners / apartments for rent (of course there will be conditions and criteria that took me personally two hours to understand 🙂) But this is another "sedative shot", add that Miami County is slowly returning to a normal life so the words "collapse" and "loss" will probably remain "meaningless words", days will tell.

At the moment people are not really buying but sellers are not yet lowering acquaintances. It will take another month or two until everyone starts to feel what is happening and there will be a crisis here

Markets that are not really related to the tourism industry (Philadelphia for example) are not supposed to go down much. Not that I understand big, just guessing, around the 10% 15% and

Even in the previous crisis, it took a quarter or two for them to really start to feel.

Almog Hemo

The more touristy states, like Florida, New York, California will suffer the hardest blow because indeed many tourism workers will be fired and not return to their jobs. At the same time, it should be understood that people receive unemployment benefits and do not live on savings that will run out. We are talking about 25% unemployment out of a market of 130 million employees, when this figure is quite stable in recent weeks. The question is how many of those unemployed will currently return to work, how many will find a new job and how many will be left without a job. In my estimation, there will be some impact in the touristy areas and very low impact in the less touristy areas.

Yes but not now, another half year to a year