Hello everyone….

Hello everyone.

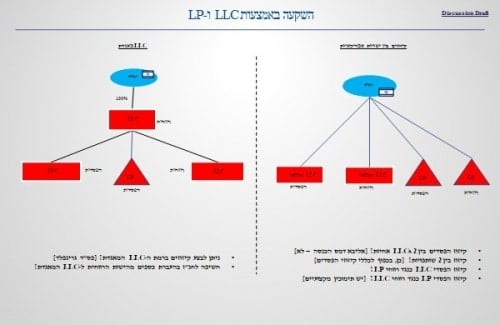

After purchasing a first single (via llc).

Is it worthwhile to manage the entire financial system of the rental, etc. through the account from the country, or is it worth opening an account in the United States?

Thanks in advance for the season !!

You can open a private / business account through Omega. Very reliable and helpful

It is worth opening the lhc only of the llc

In the meantime it is not (difficult) to get physical, I recommend you open a business account in transferwize

How do you open an American llc in a US bank? Need to be present?

Who can arrange the opening of llc, CPA?

In addition to the friends who answered I will add that it is very very convenient to work with a US account when the property is in America. You get a debit / credit card with which you can easily pay bills (taxes, flights, repairs, utilities if any), etc.). And it will be very easy for your tenant / management company to transfer the funds to you. You have an online account that you can enter from the country conveniently, manage everything from there. Compared to an account of the country, which from past experience can tell you that it is very cumbersome to work with when conferences in America.

Beyond Tal's answer, you do not have the option to open an account for the LLC's entity in Israel

Separate account for LLC in the US .. Each check will be issued in the name of the LLC, for example from the insurance if it happens, or at the sale, so you will need an account. Beyond that a separate account emphasizes the fact that this is a separate legal entity from you and so is the case of a claim if you will enjoy the separation that the LLC provides