Are you considering a 15-year mortgage? Advantages and Disadvantages

Interest rates at record lows? You will probably think about refinancing a mortgage to save money. If you currently have a 30-year loan, you may have trouble deciding whether to refinance a 15-year mortgage or stick to a 30-year term.

Moving to a 15-year mortgage will allow you to repay your home faster and save more money on interest. But refinancing a short-term loan can increase your monthly mortgage payments and make it harder to meet them.

What is a 15-year fixed-rate mortgage?

A fixed-rate mortgage for 15 years is a mortgage in which the borrower repays it for 15 years at a fixed interest rate. This means that the interest rate on the original loan will not change throughout the course of the loan. Fixed rate loans are more desirable for some sellers because they do not have to worry about which direction interest rates will go in the future.

What is a good 15-year fixed-rate mortgage?

The answer depends on the day, although rates tend to fluctuate widely over weeks and are affected by a number of macro factors. For example, the rate you receive is affected by your credit rating, loan amount, your income level, how much down payment you make and more.

To help you determine which loan period is best for you, here are the main pros and cons of a 15-year mortgage.

Benefits of moving to a mortgage for 15 years:

You will save a lot in interest

Moving to a 15-year mortgage can save you tens of thousands of dollars. Because the repayment period is much shorter than a 30-year loan, there is less time to accrue interest, which will lower the total cost of your mortgage.

Refinancing a 15-year loan can also significantly reduce your interest rates. Lenders can offer better rates on short term loans as they are less risky. The 15-year mortgage rate is usually between 0.25% and 1% of the 30-year loan rate.

If your credit score has improved or the interest rate has dropped since you took out your loan, you can see an even bigger drop in your interest rate. If you bought your home in 2018 or 2019 when the 30-year mortgage interest rate hovers around 4%, you can shave over 1.5% of the interest rate by refinancing.

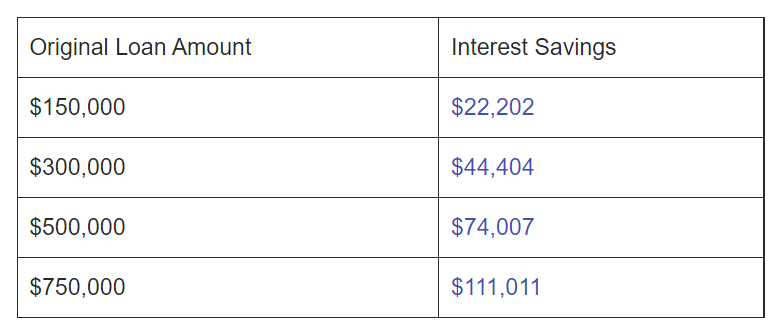

To get an idea of the savings you can experience by refinancing in this low interest rate environment, see the table below:

Chart based on a 30-year mortgage taken in 2018 at 4% interest and refinanced to a 15-year loan at a rate of 2.38%

You will build equity and pay for your home faster

Because 15-year mortgages have lower interest rates and larger monthly payments, they allow you to build equity faster. If you need this money in the future to renovate your home or go through a period of unemployment, you can utilize it through a home equity loan.

Because you can redeem your equity, 15-year loans are like forced savings accounts. If you are always paying your bills on time but struggling with savings, moving to a 15 year mortgage can help you.

Another benefit of refinancing is that you can pay off your home ahead of time. Many people find that owning their home completely gives them tremendous peace of mind because they know they will always have a roof over their head.

Fifteen year loans are also a good choice for people approaching retirement age. If you do not have a mortgage, it will be much easier to live off a fixed income.

Disadvantages of moving to a mortgage for 15 years:

You may have higher mortgage payments

Because they are repaid on a shorter schedule, 15-year loans usually have higher monthly payments. This can make it difficult to set up your mortgage, especially if you have an unexpected loss of income.

Run the numbers on a mortgage calculator to make sure your new payment does not stretch your budget. In general, it is forbidden to spend more than 30% of income on housing. You should also have an emergency fund that you can use to cover your mortgage if you lose your job.

You will have less money to spend

Spending a lot on your mortgage every month means you will have less money to invest in high-yield investments. Homes rise at a rate of less than 4% per year, while investment in the stock market yields an average annual return of 7%. Although moving to a 15-year mortgage is a great way to force yourself to save, your money will grow more if you invest it instead.

Is there any point in switching to a 15-year mortgage?

Before you move into a 15-year mortgage, it is important to make sure that the total interest savings will outweigh the costs. Since refinancing involves taking out a new mortgage to replace your old one, you will have to pay closing costs, which typically range from 2% to 5% of your mortgage balance.

Experts say refinancing is worth it if your new mortgage interest rate is at least 1% lower. However, if you are planning to move into an apartment in the near future, it may be best to hold back. Even if you get a significantly lower interest rate, it can take several months or years to recoup the money you spent on closing costs. You can use a calculator to see if refinancing will save you money based on how long you are going to stay in your home.

Is it better to get a 15-year mortgage?

What should you do if you are buying a home and taking out a purchase loan? Should you get a 15-year mortgage or stick to a traditional 30-year loan?

If you can afford a higher mortgage payment without putting other financial goals like investing on the fire, a 15-year loan may make sense for you. You will save thousands of interest and be mortgage free half the time.

But even if you can afford a 15-year mortgage, there are some good reasons not to choose it. Because 30-year mortgages have lower monthly payments, they allow borrowers to win larger loan amounts. If choosing a longer-term loan allows you to purchase the home of your dreams, you may feel worth paying additional interest.

Thirty year loans also give you greater financial flexibility. You will not be locked into a large mortgage payment, so you will have more money left over each month to save, invest or spend.

15-year mortgage alternatives

Make additional mortgage payments

Instead of refinancing your mortgage for 30 years, you can make additional payments to lower your total interest costs. An easy way to do this is to pay off your bi-weekly mortgage instead of a monthly one. By the end of the year, you will pay an additional mortgage payment without thinking about it.

This strategy can also save you thousands over the life of your loan. For example, on a $ 250,000 mortgage with 4% interest, you can save $ 28,462 and shorten your loan period by almost 5 years just by switching to a bi-weekly payment schedule.

20-year mortgage

If you can not afford a 15-year mortgage but still want to save on interest rates, you may want to consider 20-year loans. They have lower monthly payments and still allow you to repay your mortgage early to save money.

Responses