Investing in Real Estate vs. Investing in Stocks: What's the Difference?

Investing in Real Estate vs. Stocks: What's the Difference? Both have benefits and risks!

There are basic differences when it comes to investing in real estate or stocks, but the extent of your success with one of them depends a lot on timing.

Very few stocks would win buying offshore California properties in the 70s and selling 20 years later, and in fact no real estate acquisition could beat the returns you would have earned if you had invested in shares of Microsoft, Apple, Amazon or Walmart in the early history of The companies.

It is impossible to predict the timing when choosing an investment. But understanding each type of investment is the key to choosing the best strategy to help your money grow and create financial security.

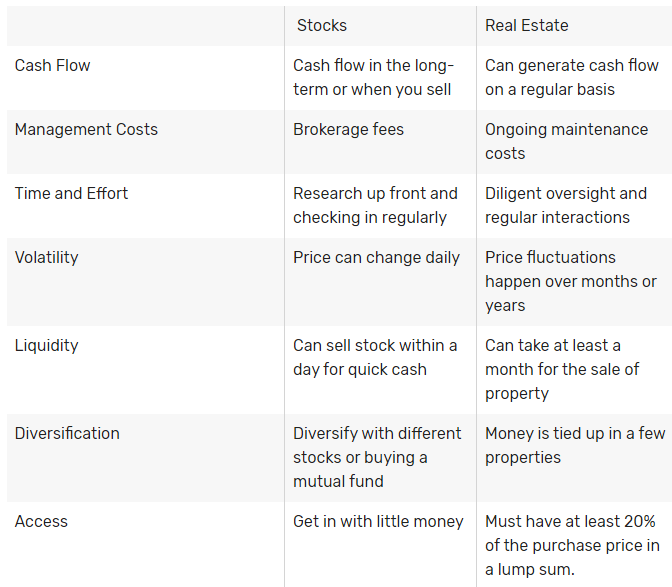

Investing in real estate versus stocks at a glance:

Investment in Real Estate vs. Stocks: Cash Flow Statement

When you invest in real estate, you are buying physical land or property. Some real estate costs you money every month you own it, like a vacant plot of land on which you pay taxes and maintenance while waiting for a sale to an entrepreneur.

Renting a real estate can provide a stable and reliable cash flow on a monthly basis. Some real estate is cash-generating, such as apartment buildings, houses for rent, warehouses or a mall where you pay expenses, tenants pay rent, and you keep the difference as a profit.

Cash flow from investing in stocks is not the same as the cash flow that will come from renting a property you own. Most cash from stocks comes in the long run when you sell. However, investors can be paid while holding shares through dividends. You can reinvest your dividends. If you use the cash that a company sends you for owning its shares to buy more shares, over time, you should hold many more shares, which entitles you to more cash dividends.

It is easy for a stock to be more or less valued. Before investing, study the company as a whole, including how much of its profit is paid as a dividend. If the company pays more than 60% of the profits as dividends, it may not have enough cash flow to cover unexpected changes in the market.

The company’s board of directors, elected by shareholders just like you, decides how much of the profit will be reinvested extensively each year and how much is paid as cash dividends.

Investing in Real Estate vs. Stocks: Management Costs

Real estate can cost you money every month if the property is uninhabited. You still have to pay taxes, maintenance, services, insurance and more. If you find yourself with a higher than usual vacancy rate due to factors beyond your control, you can actually lose money every month.

While you may pay brokerage fees or mutual fund manager fees for managing your stock investments, they are relatively smaller than they can be for, for example, the cost of managing an apartment building or other real estate investment.

Using leverage (debt) in real estate can be built much more securely than using debt to buy stocks by trading profitably.

Investing in real estate versus stocks: time and effort

Compared to stocks, real estate requires a lot of practical work. Need to deal with midnight phone calls about bathroom water leaks, gas leaks, the possibility of suing for a bad plank on the porch and more. Even if you hire an asset manager to take care of your real estate investments, managing your investment will still require occasional meetings and supervision.

When you buy shares, you are buying part of a company. If the company has 1,000,000 shares, and you hold 10,000 shares, you own 1% of the company. Unlike running a small business, owning a share of a business through stocks does not require any work on your part, other than researching the company to determine if it is the right investment. You benefit from the results of the company but do not have to get to work.

.

Real Estate Investment vs. Stocks: Volatility

Real estate investing has traditionally been a great inflation hedge to protect against a loss in the buying power of the dollar. While real estate can go down over years or decades in some areas, most investors who see this starting to happen can sell their investment before they lose money.

Stock prices can experience extreme fluctuations in the short term. Your $ 40 stock can reach $ 10 or $ 80. If you know why you are a shareholder of a particular company, it should not bother you in the slightest. You can use the opportunity to buy more stocks if you think they are too cheap, or sell stocks if you think they are too expensive. And if you hold well-valued stocks in the long run, those highs and lows are often smoothed. But if you hope to make money fast, stock volatility can work against you.

Borrowing against your investments is much easier in stocks than in real estate. If your broker has approved a mortgage loan for you, it's as easy as writing a check against your account. If the money is not there, a debt is created against your shares, and you pay interest on it, which is usually quite low.

Investment in real estate versus shares:

liquidity

When it comes to investing, liquidity is the ability to get cash out of your investment easily. Shares are much more liquid than real estate investments. During normal market hours, you can sell your entire position, many times, in seconds. It may take a few days to see the return, but you can get out of your investment almost whenever you want.

When you own a real estate property and need to sell it for cash, it can take at least a month. You may need to register real estate for days, weeks, months, or in extreme cases, years before you find a buyer. Once you find a buyer, your property goes into a 30-day trust, during which there are checks, title searches, document signatures and bank transfers that must be made before the property changes hands, and you get the money.

Investment in real estate versus shares:

Diversity

Both real estate and stocks can provide long-term financial gain, and both have risks. When choosing the right investment strategy for you, the best way to hedge against risk while taking advantage of potential profits is to diversify as much as you can.

You can diversify more easily with stocks than with real estate, especially with mutual funds. You can buy shares in several companies so that if one hits, you can still make money on another. Mutual funds carefully select stocks to ensure that the funds are properly diversified.

Unless you have unlimited funds, when you invest in real estate, you can diversify by carefully choosing the locations and types of properties you buy.

Investment in real estate versus shares:

access

You do not need huge sums of cash available to start investing in the stock market. With a few mutual funds or individual stocks, you can only invest $ 100 a month. There are also micro-saving apps that let you start investing for less than $ 25.6

Real estate requires a lot more money in your initial investment, as well as the maintenance and improvement costs. The growth in the popularity of real estate investment trusts (REIT) allows more people to pool their money to buy real estate.

Investing in real estate gives you the benefit of a tangible asset that can generate income and protect against inflation.

Real estate requires a continuous investment of time, effort and cash, and its true value rarely changes over time.

Stocks are highly liquid investments that can both build long-term wealth and provide income through dividends.

Stock market investments often experience short-term volatility that can lead to emotional decisions to buy or sell at the wrong times.

Click for help in finding the right investments and assets for you.

Responses