What is a Wholesaling Real Estate Wholesaler?

Wholesaling - Wholesale Real Estate

Wholesale Real Estate This is an effective route for new investors to break into the real estate market without investing significant capital. Read on to learn how a real estate wholesaler works and whether it is right for you.

A real estate wholesaler is a business venture in which a wholesaler enters into a contract with a property owner and then assigns the contract to an end buyer for profit.

The wholesaler makes money when the buyer agrees to pay more than the sale price promised to the seller.

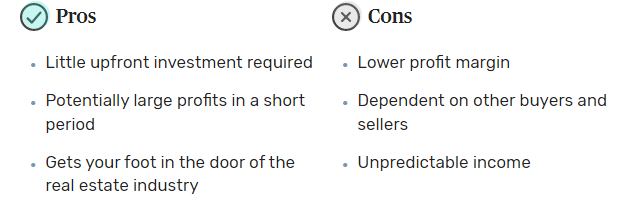

A real estate wholesaler does not require a lot of capital in advance because the wholesaler does not actually purchase the house. As a result it is a more accessible form of real estate investing.

A real estate wholesaler needs significant marketing and networking to find sellers and buyers to do business with.

Wholesale real estate may have lower profit margins than other forms of real estate investing because of the minimal risk and investment required for a wholesaler.

Definition and examples of real estate wholesale:

A real estate wholesaler is a business venture in which a wholesaler sells a property on behalf of the owner for a profit. The wholesaler and the seller enter into a contract, which the wholesaler eventually sells to another buyer.

The wholesaler does not actually purchase the property. Instead, the temporary contract with the owner gives them the right to sell it on their behalf, while keeping the profit to themselves.

advice: The assets that wholesalers sell are often distressed assets outside the market. The owner no longer wants the house, nor does he want to do the work necessary to prepare it for a traditional sale. They communicate with a wholesaler instead of taking it out of their hands.

How does a real estate wholesaler work?

A wholesale real estate transaction includes a contract between the seller and the wholesaler. The wholesaler agrees in the contract to sell the property for a minimum amount up to a certain date. This may require them to invest some serious money. A wholesaler may agree to sell a property for $ 150,000 within 90 days.

The wholesaler finds a buyer after signing the contract, usually a real estate investor. The buyer accepts the contract. The goal of the wholesaler is to sell the property for more than the amount listed in the contract. The wholesaler may try to sell the property for $ 175,000 if he has a contract listing the price at about $ 150,000. The difference between the contract price and the sale price is known as "The space". This is the profit of the wholesaler. That would be $ 25,000 in this case.

Advantages and disadvantages of real estate wholesale:

What does this mean for individual investors

Real estate has been a popular investment strategy for decades. Gallup polls consistently show that Americans believe real estate is the best long-term investment, and are winning stocks.

Otherwise, real estate can be daunting for a single investor because of the upfront investment required to purchase homes and the ongoing annual investment of time and money.

A real estate wholesaler can be a good entry point into the real estate world. It takes a little investment on your part, beyond what you pay to market the property to buyers and sellers. You can consider a real estate wholesaler if you have considered entering the real estate field but you do not have the savings to do so.

Is it worthwhile to be a real estate wholesaler?

As with any business or investment opportunity, you may find yourself asking if a wholesaler is worth it. The answer is: Depends.

A wholesale sale of real estate can be profitable and has the advantage of needing capital early in advance. But you must also consider whether it is really something that interests you. Real estate wholesale requires marketing and networking. You will probably also need a deep understanding of real estate and the local market.

You may find that the effort required to make a profit is not worth it if you do not enjoy marketing and networking.

A real estate wholesaler can be worth it if you have a passion for real estate but only need the capital to help you get there. A real estate wholesaler gives you the experience and profits to reinvest in your next business venture.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5):format(webp)/RealEstatewholesaling-f96ecd8d28be482daa8b2bcbeb035e14.jpeg)

How to start being a real estate wholesaler

You will first need a marketing strategy to attract sellers and find properties outside the market. Marketing strategies may include direct marketing, online advertising, cold calls and search engine optimization (SEO).

Check the laws regarding wholesale in your country, or ask a local lawyer to do so. Some states enforce regulations that you must comply with.

You will also need a network of ready-made buyers. Buyers in wholesale real estate transactions are usually real estate investors who are willing to pay in cash. You can find investors through social media platforms like Facebook or LinkedIn. You can also join local real estate investment meetings. Some investment groups even offer wholesale training courses.

That you will have a list of people to call when you have a property to sell after you have built your network.

Common questions:

How much should I offer for a home?

You want to ensure a profit, so about 70% of the home value after the repair is usually a good place to start. But do not forget to take into account the cost of those repairs.

Do I need a real estate license to be a wholesaler?

Check with a local lawyer to be sure, but most states do not require a license provided you do not actually conduct the sale. You're just acting as a broker in the deal.

Wholesaling course - how to do it right with Gal Schmuckler and Lior Lustig

Responses