Are lower mortgage rates a holiday gift for homebuyers - or a temporary reprieve?

The flurry of bad news in the housing market was interrupted last week by a sliver of good news. Finally.

The foreign mortgage interest, which caused deep financial pain for many apartment buyers and led to a freeze in the housing market, decreased by half a percent last week. They fell from above 7% to 6.6% for 30-year fixed-rate loans in the week ending Nov. 17, according to Freddie Mac.

However, buyers should not celebrate just yet.

Many real estate experts believe the low rates are a temporary reprieve, not a sign that rates will return to the 2% and 3% ranges seen last year. In fact, many expect rates to return to around 7% this year.

"The sharp drop in mortgage interest rates this week has opened a window of opportunity for buyers looking to lock in their interest rates. With the lower rate, they not only save money on their monthly payment, but a significant amount in interest over the life of the loan," says Realtor.com Director of Economic Research, George Ratio.

But the good times are not likely to last for long, he says. "I still expect that interest rates may move back towards 7% in the coming weeks."

The rate break will save buyers about $100 a month in their mortgage payments - and almost $48,000 in interest over the life of a 30-year fixed-rate loan. (That's assuming they took 20% off a median home price of $425,000, not including taxes and insurance.) While that's encouraging for buyers who have struggled with how to get the home ownership pencil math out, prices are still high and runaway rates haven't cooled enough to make much of a dent. .

But most experts believe the big increases in mortgage rates, which have more than doubled in the past year, are in the rear view. While they expect interest rates to ease slightly, they expect mortgage rates to remain in the 7% range, but not reach 8%.

This "suggests that mortgage rates may have peaked," Bright MLS Chief Economist Lisa Strutbant said in a statement. The multiple registration service covers the Mid-Atlantic region. But she warns, "it is likely that there will be continued volatility in rates amid economic uncertainty."

Why did the mortgage interest rate go down?

Mortgage rates go up and down for a variety of complex - and often competing - financial reasons.

When the Federal Reserve raised its interest rates to fight inflation, mortgage rates rose similarly. Since inflation is still high, the rates are also expected to remain high.

"Inflation really tends to drive mortgage rates," Ratio says.

However, there are signs that inflation may be easing. The Fed scored a victory earlier this month when the October inflation report was released. Inflation began to cool in earnest, moving from a year-over-year high of 9.1% in June to 7.7% in October.

This cheered investors, who also have a large part in determining the direction of mortgage interest rates in the mortgage bond market. Lenders typically bundle mortgages they make and then sell them to investors to free up more cash for new loans.

When inflation is high, investors seek higher returns on their purchases of mortgage-backed securities, aka mortgage bonds, in the form of higher mortgage rates. As inflation appears to be responding to the Fed's actions, they hope the Fed will slow its rate hikes. So there isn't as much pressure on rates to stay high.

"When there is higher inflation, investors ask for higher returns. But now we see that inflation is cooling, rates are cooling as well," says Nadia Avangelo, director of real estate research at the National Association of Realtors®. This does not mean that the rates will remain slightly lower.

"We expect the rates to be volatile until we see a further slowdown in inflation," adds Avangelo.

In addition, lenders are also doing their best to keep rates low enough to attract customers, says National Real Estate Appraiser Jonathan Miller.

The problem with higher mortgage interest rates

Higher mortgage rates effectively froze the housing market.

Along with the still high housing prices, many who planned to purchase their first homes can no longer qualify for loans. Others had to drastically cut their apartment purchase budgets. Although house prices are starting to fall, they will have to fall dramatically to overcome the higher rates. So although there are many who would like to become homeowners, they can no longer afford to do so. So home sales fell.

"If interest rates were reduced now, we would have another housing boom," says Miller. "The demand is still there."

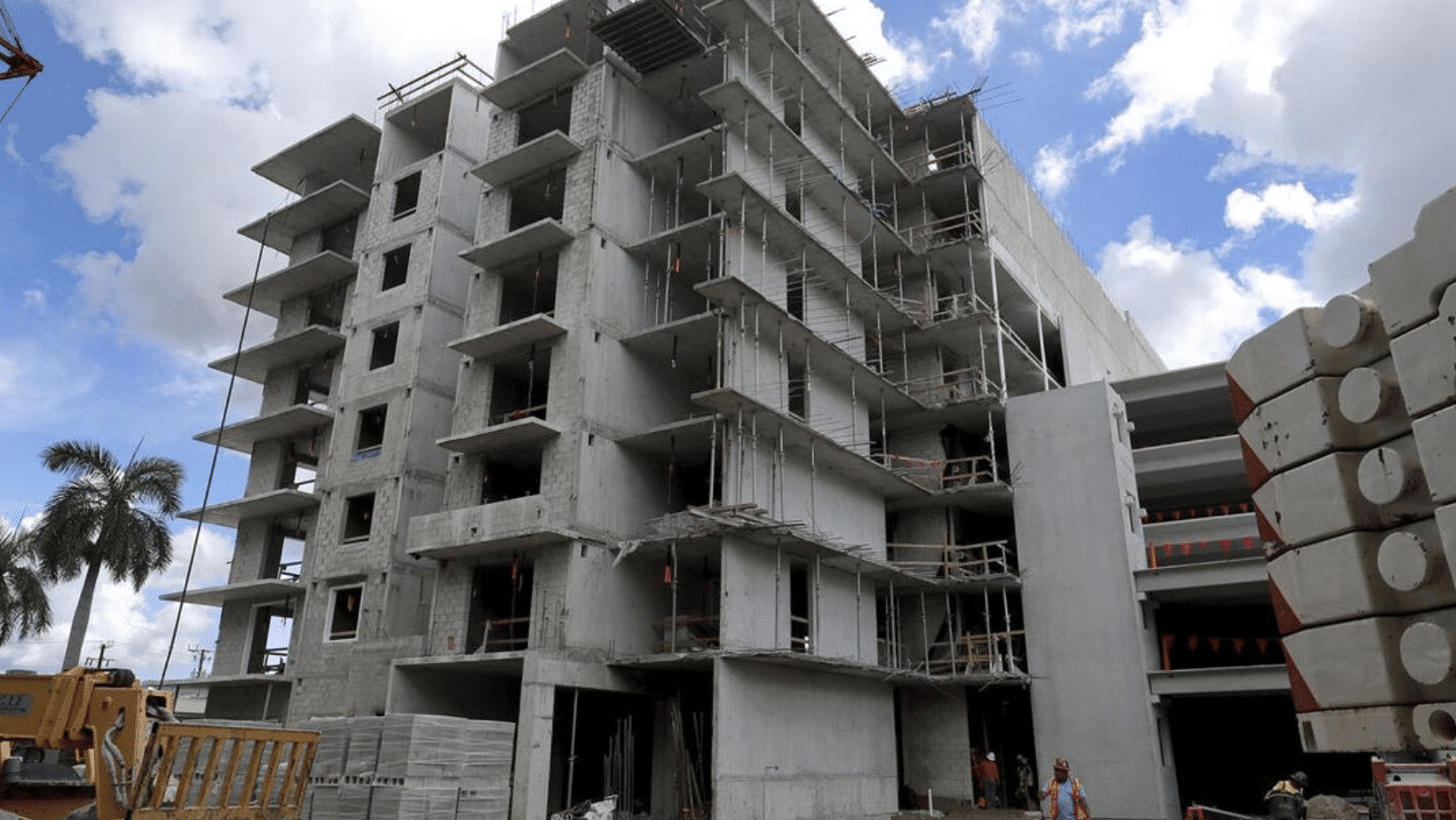

The number of houses for sale is also still critically low. Builders who fear that they will not find buyers for their residences are slowing down the pace of construction. And sellers, most of whom are also buyers, are reluctant to give up their low mortgage rates to buy a home with a new loan at a higher interest rate.

"People are wedded to their mortgage rates, and they're not ready to become buyers with all the uncertainty," says Miller.

Plus, many buyers don't realize mortgage rates have dropped, says mortgage broker Rock Andrews of Lending Arizona in Tucson.

"Hopefully this means rates are coming down so people can start planning their purchases," he says. "Buyers may be a little more interested in going out to look at houses."

And as high as mortgage rates are today, they are still significantly lower than they were. In 1981, rates peaked when they briefly topped 18.5% for a 30-year fixed-rate loan.

"What we have to remember, this is better than a rate of 8%, which is the historical average," says Avangelo.

Responses