Tips for First Time Home Buyers in South Florida

South Florida real estate agent Malcoy Mason provides his best tips for first-time home buyers during this seemingly troubled time in real estate and the economy.

It's always a good time to buy.

Mason's first tip clears up the misconception that there are bad times to buy. "Everyone needs a place to live," states Mason. He goes on to point out how scared people can be of home ownership. "People think that owning a house is a big responsibility, but it's actually peace of mind," he explains. He points out that there is no cap on rental rates in Florida, while mortgage interest rates are currently six or seven percent.

Find the best mortgage plan to suit your needs.

According to Mason, a great mortgage loan officer who can find the best mortgage plan to fit your needs is extremely important. For example, he notes that there are mortgage programs for first-time home buyers, as well as programs designed specifically for certain types of professionals, among several others.

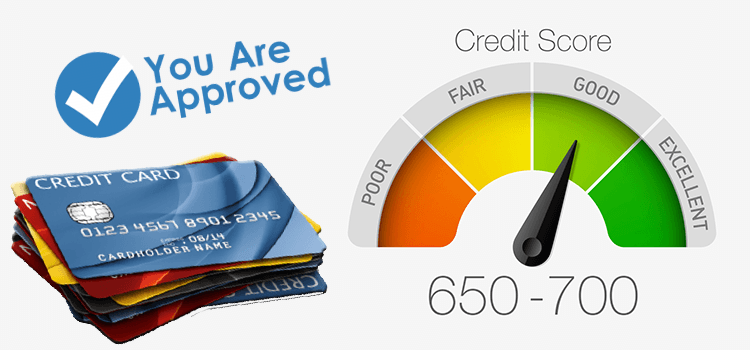

Start with your credit score.

Mason notes that a credit score of 680+ will help you get the best mortgage scenario possible. If possible, spend some time building your credit score before you start the process of searching for your first home, he advises.

Consider homeowners insurance for your monthly expense calculations.

In markets like Florida, with seasons of possible extreme weather, such as hurricane season, homeowners insurance is even more expensive. Also, ideally any home being considered for purchase should be built after 2002 and have some basic amenities such as hurricane strips, modern roofing, modern plumbing and modern wiring. Your real estate agent should be able to provide information on the status of all of these, but you should also talk to insurance agencies about current rates for potential homes, Mason advises.

Do a home inspection.

Mason explains that a third-party home inspection should always be a step on your checklist when buying a home. A home inspection covers many aspects, including investigating plumbing, wiring, drainage, stability, and possible infestation of termites, rodents, etc. Mason points out that the last thing you want is to be two months into paying off the property and find out what would have been a definite deal breaker.

Hire a good real estate agent.

A good real estate agent makes the process almost frictionless, says Mason. This is someone who is paid to demystify the process and guide you every step of the way. He recommends taking your time to find a good real estate agent, because you want the best to work for you. Bad house hunting stories usually have bad agents, or good ones overlooked.

Responses