Connecticut

In this group you can offer real estate deals, share information about the state and the cities in... View more

Offer to purchase a building at a price that is significantly below the market price: 3 investors + Lior

-

Offer to purchase a building at a price that is significantly below the market price: 3 investors + Lior

Hello friends,

Many of you turn to me every day to ask if there are any new multi-party transactions worth entering.

As you have seen, since sending the last deal in January which was really a great deal below the market price it has been over three months, and there have been no deals that I believe are good.

To my delight, after many searches, I found a deal that I think is very good and that after exhausting negotiations I managed to lower the price to a very attractive price.This is the building of 6 + 2 apartments stores in Connecticut.

The building is offered well below its market price - the investor is a musician from Europe who does not understand much about real estate and is not able to handle the management of the building. Also the building taxes are high, and after the purchase he struggled with the taxes by taking a lawyer who specializes in the subject.

The deal came out at the price of 330,000 dollars. A pre-price is designed to allow for quick closing.

For those who followed my lecture on property prices in Connecticut, see that the average price of a one- or two-room apartment in Hartford is about $ 65,000. In this specific area, property prices are a little lower - the price ranges from 45-55 thousand per apartment in small transactions, and 55-62 thousand dollars per apartment in transactions of multi-apartment buildings. (That is, the larger a building is purchased, the higher the price per apartment).

If we take the lowest price for an apartment in the area, it seems that the market value of such a building is at least: 360,000 USD, meaning the initial price it was offered was 30 lower than the market price to allow for a quick sale.

The price of an apartment of 45 thousand dollars will usually reflect a building that needs renovation - and this is not our case - the apartments were completely renovated 5 years ago - which means great future savings on repairs and renovations and increasing cash flow. There are several reasons why the building was not hijacked and where is our opportunity as real estate investors - an explanation below.The building is offered to us at an average price of only about $ 30,500 per unit. Much cheaper than the price per apartment offered in the portfolio of 42 apartments for those who remember! (47 thousand per unit) - to get such a price we had to buy a cluster of 5 buildings!

We only enter into super secure solid deals so we will leave a reserve of $ 56,000 in a bank account for all apartments for closing and security costs in case renovation and upgrade is required - the building is currently working and rented out in full and probably does not need immediate renovation but usually building purchase. In them. Also as you will see in detail below, we will have to pay professionals who will help us improve cash flow. We always leave a security amount from investors for closing expenses and in any case so that we do not have to come to you another year with requests for additional funds, for example if you need to replace a roof, heating system, etc. (Although in real estate anything can always happen, so I prefer to add to my investments experienced investors who understand what it is like to be involved in renovations and dealing with tenants)

Target market value after stabilization and reduction of taxes: It is estimated that the value range will range from $ 360,000 per 45 per apartment to $ 520,000, according to $ 65 per apartment, according to comparative prices for the area - and as is well known in multifamily the value is determined by cash flow. The value of the building.

The current price after the negotiations: only $ 244,000 - at least 33 percent below the market price according to a calculation of $ 45 per apartment (the calculation with the lowest price)

Building Information:

1. The building is on a central street in Hartford, the insurance capital of the United States. Two hours drive from Manhattan.

In the property area there is a university, hospital, transportation and more. The street has a large number of shops, restaurants, bakeries, supermarkets, furniture stores, hair and nail design, clothing and jewelry and it is a bustling street for better or worse - it is a street with a weak population of African Americans and Hispanics, who will often be our tenants in this type of investment. An area that can be classified as C + level.

At such price levels for the apartment, these are the areas of investment most of which we will be in, but we know that these areas also have the highest potential for high returns.

Near the property there is a Bank of America branch within a five minute walk, Family Dollar, Ace Shop and Build in the Home Depot style, etc. - a central area that does not require car ownership for tenants who cannot afford it. Our tenants will include people who work in these businesses.

The restaurants are considered very good in the eyes of the locals - food at the level of the food market of Dizengoff Center but with a setting of Neve Sha'anan.

Imagine Bialik Street in Ramat Gan but with African Americans and Hispanics - that's the style.

The municipality is also working on cultivating the area and has approved the establishment of a new library for children on the street that will increase the attractiveness of the entire area. For those who do not know and know - the libraries in the United States serve as a complete cultural center for the area, and include activities for children, performances for children, plays, etc. - far beyond the book library, and make young families want to live near the library. The children are in the library most of the day after school, meeting with friends, doing homework, etc. - mothers who do not work and have small children go to library activities for children that often replace the need for kindergarten for those who cannot afford it.2. This is a mixed-use property - 6 2-room apartments (3 rooms by Israeli standards), and 2 shops.

The advantage of this is that we are not dependent on one type of income, and store owners will usually stay for a long time if their business is successful - in a similar property where there was a restaurant, the owners were there for 50 years - a family restaurant - it is rare for a tenant to stay 50 years. (Of course, if the business does not succeed, there may be a high turnover.)

3. Big advantage to the building - the tenants pay for the heating and hot water! Each apartment has a separate electricity meter and heating!

It's really not obvious - in most buildings the landlord pays for the heating because there is one heating system per building without separating the boiler per tenant - separating the heating systems costs a lot of money and beyond that it dramatically saves expenses, especially in cold countries, it also raises the The value of the building and its attractiveness.

4. The building is made of bricks and therefore resistant to all weather conditions and its maintenance is easy. This figure is very important especially in cold countries that suffer from weather conditions.

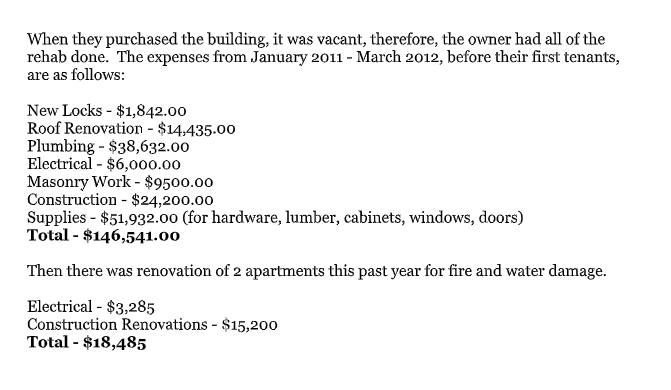

5. The roof is only 8 years old - was replaced in 2011 - which means we should have at least another 22 years of income without a roof replacement.

6. All apartments have been completely renovated just 5 years ago! Low expenses!

7. All heating systems and water heaters have been replaced!

8. The building is fully occupied!

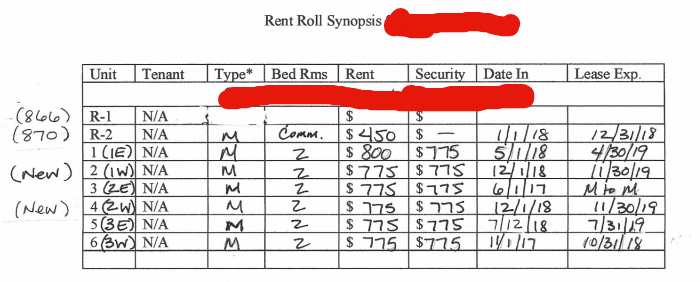

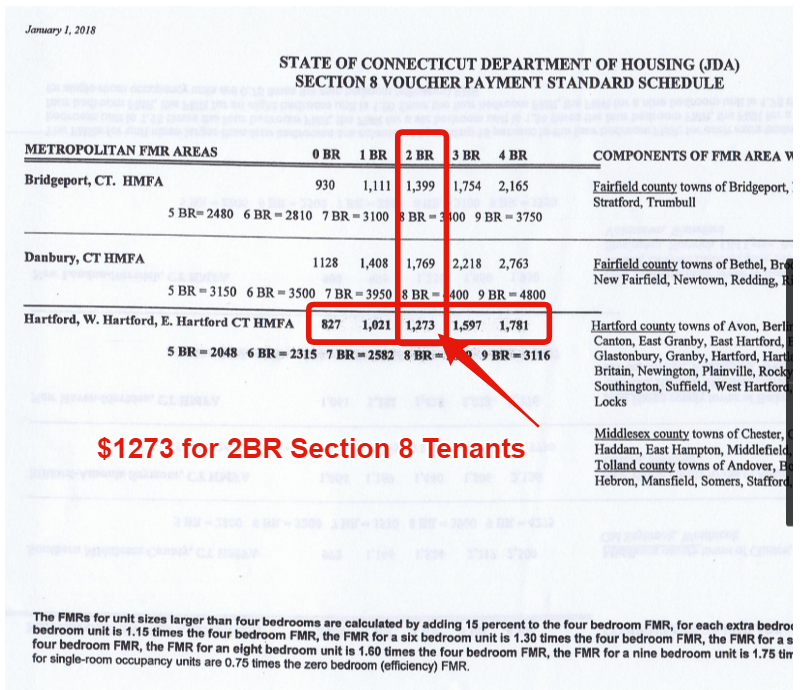

9. The rents are below the market price - therefore there is great potential for raising the rents.

10. All electrical and sewage and water systems have been upgraded to the required level of code!Investing: 300,000 USD ONLY!

Reserve account: 56,000 dollars

Estimated closing costs: $ 10,000 (inspection, lawyer, etc.) - will be taken from the reserve.Total fundraising: $ 300,000, from three investors

Structure of the investment:

3 Investor who invests each 100,000 Dollar (3 Investor + Lior)Strategic Plan:

After the purchase we will raise rents every time a tenant leaves the apartment.

Every time a tenant leaves, we will make a basic renovation and upgrade if necessary, and try to get a tenant into a higher rent.

To keep the investment solid and safe - we will distribute a current cash flow in case there is at least $ 50,000 left in the reserve fund and we will prefer to invest back in the building in the first two years to increase its value.We remind you that in a commercial property the value of the building is determined by its cash flow - so our goal will be to reduce expenses and raise revenue.

For anyone who does not know the process, I recommend watching my lecture on MultiPharmy:

https://www.youtube.com/watch?v=XaVajBiKJo8The problems and improvements to be made in building to improve cash flow:

The building currently provides a Wright's 6 percent cap. The goal is to do the following to upload it to 10 percent:

1. Raising rents to market prices - an increase of 50 to 100 dollars per apartment. Also offer tenants parking in the nearby parking lot - we will not accept payment for parking because the parking is not ours, but many tenants are looking for apartments with parking so this option gives us an advantage in advertising the apartments for rent.

2. Lowering the cost of electricity and water - At the moment the cost of water and electricity in the common areas is much higher than usual - we will take a paid electrician to check the cause and fix it. The goal is to bring the cost of electricity from $ 1700 per year to $ 750 per year - a price that is a monthly average for similar properties. The price of water is expected to drop from $ 4000 a year to $ 3600 a year. (Look at the attached Excel image.)

3. We will look for a better offer for insurance - should go down from $ 6500 per year to $ 5600 per year according to similar buildings.

4. Fighting for tax cuts - a process that can take about two years - the goal is to lower taxes from $ 24,457 annually to $ 19565 - taxes on similar assets. Lowering taxes immediately causes an increase in the value of the property. For those who are interested let me know about the process I did on my New York property - a process that raised the property value by 40 percent - I also intentionally purchased it with high taxes because Americans are afraid of the process and it creates an opportunity to buy a property below its market price.

5. We will replace the anti-fire monitoring company and add video cameras to guard the property - the price of the monthly call should drop from $ 1850 to $ 1000 according to the price of similar properties.Also remember I live an hour and a half drive from the property which is a huge advantage - I can be present at all tests, be physically with the lawyer to go through the documents and sign, work directly with the management company, get several quotes instead of with construction companies for example if a roof needs to be replaced And to do the physical tour of the building with them - something that is impossible for investors living in Israel.

Refinancing:

After completing the above process, we will mortgage the property and issue 80 percent of its value - the money will be divided into five and returned to investors.

The interest rate I can get as an American as a high income earner and excellent credit today is about 4.5 percent for 25 years so the financing I bring in will save investors a lot of money. For those who saw in my lecture - for every financing of a property worth a million dollars at 5 percent interest instead of the 9 percent interest that Israelis receive, the savings over the life of the property is $ 500,000 of interest payment! - I recommend you watch the whole part of the funding in my lecture.flow:

In its current state the building produces $ 17,211 a year - a 6 percent cap rate. The goal is to bring it to a cash flow of $ 31,016 per year with the help of the moves presented above (see Excel image).

The above income will be divided every six months between the 4 investors as long as the bank account has at least $ 50 as security.Investment horizon:

The investment is suitable for those who can invest an amount that is not their last money and with a horizon of 10 years ahead - the goal is to create a consistent and ongoing cash flow and not a flip - flip, sale or refinance are a bonus for the deal but not the main goal - they will be made.

If you have no experience in real estate and you do not understand that property with tenants is a full-time job and not really passive income, and that it is sometimes necessary to deal with eviction of tenants, repairing the property, sometimes going to court, etc. Although I will be the one to work with the various factors to take care of anyway, we invest in the building together - and I will definitely prefer people with experience so that we can make important decisions together and succeed together. Definitely prefer road partners who understand what real estate is and will not ask to leave after a year or two.

We will consider our move after about 5 years in terms of refinancing and spending money on investors, selling the property normally or with a tax deferral - 1031 Exchange that I can do as an American.Exit from investment:

If you are required to leave the investment, you will need to find an alternative investor who will enter your place and that is acceptable to members of the investment group. If there are attorney fees and other costs of transferring the name in the investment to the new investor, these are expenses that you will finance yourself.Summary of investment details:

We will offer to purchase the building at 244,000 USDNumber of investors: 3 + Lior

Percentage of ownership per building investor: 25%

Relative ownership of the number of apartments per investor: 2 apartments

Average price per apartment by price after negotiations before financing: 30,500 dollars

Financing percentage: At the moment, the transaction will be purchased in cash and we will carry out refinancing in continuation of the money invested

Investors enjoy excellent financing terms that we receive due to the fact that the owner of the forum, Lior Lustig, is an American with excellent credit, high income and a real estate management history that the bank wants to see:

Interest: about 5 percent - depends on the interest rate on the day of the loan. Locked for 5 years.

The life of the mortgage: 25 years.Since I am personally responsible towards the bank for repaying the loan, I am building the transaction in a super-solid form with financing of 40 percentage and security funds in the bank account.

Money saved to bank account for:

Renovation of the units to increase the cash flow and thus increase the value of the property - when each tenant leaves, renovation and increase of the rent: At the moment, no immediate renovation of the property is required - the property is leased one hundred percent

2. Closing expenses, lawyer, appraisal, inspection, bank fees, etc. - We will usually save 7 percent ($ 17) but because the property was purchased in cash the closing expenses are lower. If there is excess money left, it will be used as part of the security fund: $ 10,000

3. Security money for future repairs - the bank account did not decrease from this amount: $ 50,000 (in Excel we used a slightly lower amount but rounded the total investment to $ 300,000)

The monthly cash flow will be distributed to investors with surplus money over the security fund and the amount allocated for improvement once every six months (in order to make monthly money transfers).

An update report will be provided once a quarter in case there are relevant reports for the investment.

What the United States Real Estate Forum headed by Lior Lustig provides for the deal:

1. Comprehensive market analysis of all market assets and finding the best deals

2. Financing the transaction in the future on American financing terms with Lior's personal commitment to the bank to repay the loan - if the loan is not repaid, the bank sees Lior as a primary creditor and can seize his assets and because of this Lior is committed to a solid and secure transaction.

3. Negotiations on the price of the deal

4. A struggle with the municipality to reduce the taxes on the property

5. Establishing a new company and working with the lawyer, brokers and management companies to verify the transaction data - tenant payments, eviction of tenants, status of properties, planning status, adjustment between the payment of taxes and the reports presented.

6. Physical inspection of the building before sending an inspector - Lior Lustig lives an hour and a half drive from Connecticut and will provide video of the place during the tour and during the inspection

7. Inventions on site at the time of ordering an inspector, appraiser, contractors, management companies, etc.

8. Work regularly with the management companies and cross-reference the number of suppliers in each repair, for example when replacing a roof, bring in several suppliers and cross-reference various proposals for repair. Also working with our independent asset management software that will allow us not to be dependent on a particular management company. The software enables direct communication with the tenants, tracking of income and expenses, etc. - Lior will manage the software on an ongoing basis with the tenants and contractors in parallel with the management company.

9. Constant work on streamlining and optimizing expenses - due to extensive future activity of purchasing a large number of buildings, we can request a reduction in the cost of management and repairs, reuse of materials purchased in additional apartments, etc.

10. Work on raising the value of the properties - improving the property in order to increase the rent and thus increase its value for refinancing or selling, performing various activities on the properties to increase the income from them such as billboards, renting warehouses, washing machines and drinks, renting common spaces in the property for tenants for events, etc. Thinking outside the box as explained in Lior Lustig's lecture on the multifamily world.

11. Working with the American Accountant to produce tax returns for investors - K1.

12. Management of the bank accounts of the assets on an ongoing basis - investors will be given full transparency to the bank accounts to see the incoming and outgoing expenses.

Seriousness:

The three investors + Lior each deposit a serious fee of $ 7000 into a joint account - this amount will be used as a payment to Inspection, a lawyer, etc. If the investment does not progress, the amount left in the account will be divided by 4 and returned to investors.

When choosing an attorney, this amount will be transferred to his trust account except for the amount that is required for the payments to the various professionals.

Lior also deposits $ 7000 to show - Skin in the game - this is the amount I invest out of my own pocket for the benefit of the deal beyond all the activities I described above. The rest of the transaction amount will be divided between the three investors.Subscription fee and ongoing management:

After the initial deposit of 7000 double 4 will remain for three investors 272,000 dollars for deposit

Ie 90,666 to the investor.Instead of 32 percent of the building (remember not 33 percent because Lior also put initial money) - the investor receives 25 percent of the deal.

As you probably know - the profit in real estate is in a purchase - a purchase below the market price, and also the increase in value in the future with the improvement that Lior will manage, savings in Lior's current management fees and the financing terms that Lior will bring in the future (if possible and relevant)

We do not engage in speculation and any profit from a future increase in value is only a bonus - the deal should work from day one and we make a profit on the day of purchase.

The 7 percent difference is the Finders & Management Fee per transaction - meaning the difference is the percentage each investor pays to Lior - I enter within a fourth partner (25 percent) in exchange for locating the transaction, day-to-day operations, working with the management company, improving and refinancing at US interest.After purchasing the building beyond the current management, Lior will share the expenses and revenues equally, and after the purchase of the building, the expenses and revenues will be divided into four.

Usually for the sake of regular management with the management company Lior charges 3 percent per month of the gross rent, so let's say the management company charges 10 percent, the total management will be 13 percent per month - but in this case because Lior enters as a partner and enjoys a quarter of the cash flow, there will be no overpayment for Lior In front of the management company and Lior will do it for free as part of the cash flow he receives.

If you are interested in more details, please send a return e-mail to this e-mail by clicking on the blue button at the bottom - but it is better that you post your questions in the Connecticut Transactions Forum, which is part of the "investment arena" on the forum's website:

Register to the site with your Facebook account, click on the Connecticut forum, ask to join and we will approve it. The forum is intended for transactions relevant to Connecticut.

The "investment arena" on the site is a new and experimental format, so if you encounter any problems, do not hesitate to contact me.

You are also welcome to arrange a conversation with me for further information.

Remember - the 3 investors who transfer the seriousness fee first will enter the transaction.

The exact address of the property will be given after signing a confidentiality document and transferring the seriousness fees.

By the way - if you know an investor who is interested in joining multi-family transactions in Connecticut, you are welcome to send him / her the landing page:

https://info.www.forumnadlanusa.com/multiAppears 🙂

Lior Lustig

Director and Founder of the United States Real Estate Forum

Log in to reply.