More Sellers Pull Listings as Housing Market Softens in Late 2025

A growing number of homeowners are quietly backing out of the housing market as softer demand, slower price growth, and broader economic worries make selling increasingly difficult. New data from Redfin shows that nearly 85,000 sellers removed their listings in September, a 28% jump from the same month last year and the highest level for a September in eight years.

The trend highlights a market where many listings simply aren’t gaining traction. Roughly 70% of homes listed in September were still on the market after 60 days, a clear sign that buyers are pulling back and competition has thinned. For sellers who listed recently often at prices based on last year’s stronger conditions the reality is striking: fewer showings, slower offers, and growing pressure to cut prices.

Why Sellers Are Stepping Back

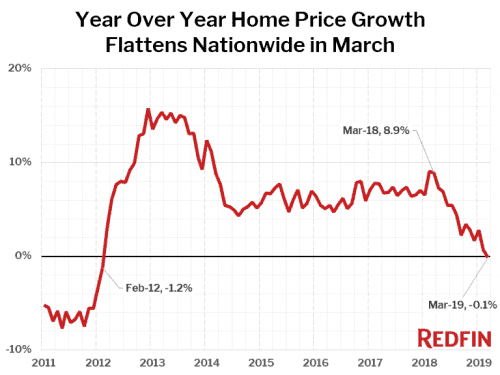

Many homeowners are choosing to wait rather than accept lower prices. The S&P CoreLogic Case-Shiller Index shows that home prices in September were up just 1.3% year over year, slightly below August’s 1.4% pace. While values are still higher than a year ago, the slowdown is enough to make some sellers nervous especially those who bought recently at peak prices.

According to Redfin, about 15% of the homes pulled from the market in September were at risk of selling at a loss, the largest share in five years. For those owners, the safer choice is to hit pause rather than risk selling below their purchase price.

“As more sellers walk away instead of taking a lower offer, the true amount of inventory available to buyers shrinks,” explained Asad Khan, senior economist at Redfin. “Even though active listings look high on paper, many of those homes aren’t really available anymore. That keeps sale prices from dropping as much as they otherwise might.”

Price Cuts Are Growing—And Getting Deeper

Some homeowners who stay in the market are turning to price cuts sometimes more than once.

Zillow reports that the typical home saw about $25,000 in total price reductions in October, matching the largest cumulative discount the company has ever recorded. The first price cut usually averages around $10,000, but repeat cuts are now more common with homes sitting longer and sellers trying to reconnect with buyers who have become extremely price-sensitive.

Slowing Season + Cooling Sentiment = More Delistings Ahead

The market is now entering its slowest stretch of the year. Historically, only about one in five delisted homes returns to the market quickly, and this year that pattern may be even more pronounced. Many sellers are expected to wait until spring typically the busiest home-shopping season before trying again.

Even though the total number of homes for sale is about 15% higher than a year ago, economists warn that inventory is likely to shrink through winter as more sellers step back and buyer demand remains soft.

Buyer and seller sentiment is weakening as well, fueled by ongoing economic concerns and mortgage rates that dipped briefly in early fall before rising again in November.

Pending Sales Show Small Monthly Improvement

Pending home sales based on signed contracts rose 1.9% from September to October, according to the National Association of Realtors. However, activity was essentially flat compared to the previous year. The monthly bump likely came from a short-term drop in mortgage rates late in the summer, which has since reversed.

With affordability still stretched and many sellers choosing to wait for a better environment, the market seems headed into winter with more uncertainty and slower movement than usual. For direct financing consultations or mortgage options for you visit 👉 Nadlan Capital Group.

Responses