Renters Shift Away From Single-Family Homes as Apartment Living Grows

Single-family rental homes are becoming a smaller part of the U.S. rental market as more renters turn to apartment living in search of lower costs and more options.

A new report from Redfin, based on U.S. Census Bureau data through 2024, shows that 33.1% of all renter-occupied homes are now in large multifamily buildings, the highest share recorded since 2011. At the same time, single-family homes now make up just 31% of rentals, the lowest level on record.

Small multifamily properties account for 27.3% of rentals nationwide, while townhomes make up 8.5%. Large apartment buildings overtook single-family homes as the most common rental type in 2022, driven by a surge in multifamily construction during the pandemic housing rush.

More Apartments, Fewer Single-Family Rentals

The shift reflects how housing has been built and used over the past decade. While construction of both single-family and multifamily homes has increased since the Great Recession, multifamily development has grown faster, especially during the pandemic.

Low interest rates during that period made it easier for developers to build apartment complexes. At the same time, strong rental demand encouraged investors to focus on large buildings that offer steady income across many units. Several cities also eased zoning and permitting rules, making multifamily projects easier to approve.

As a result, renters today have more access to apartments than ever before, while the supply of single-family rentals has tightened.

Affordability Is Driving Renter Choices

With housing costs still elevated, renters are looking for options that offer better value. Larger apartment buildings often provide lower rents per unit, more flexible lease terms, and greater negotiating power due to higher supply.

Even though multifamily construction has slowed recently, there are still more apartments available than renters, which has kept rent growth under control in many markets.

By contrast, many single-family homes were purchased by buyers during the pandemic, shrinking the number available for rent. Homeowners who locked in low mortgage rates are now reluctant to sell, keeping both rental and for-sale supply tight.

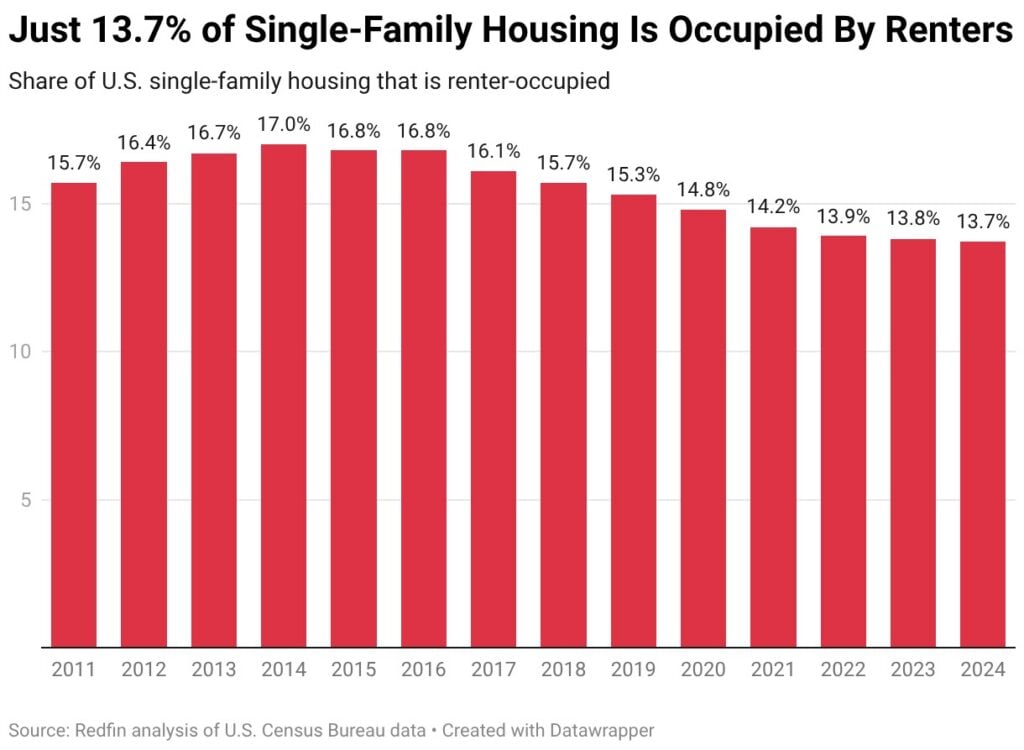

Single-Family Rentals Hit Record Low Share

Only 13.7% of single-family homes are renter-occupied, the lowest share recorded since 2011. The total number of single-family rentals stands at 11.3 million, one of the lowest levels in more than a decade.

Meanwhile, large multifamily buildings now hold 12.1 million rental units, the highest level ever recorded. Small multifamily buildings contain about 10 million units, while townhome rentals total 3.1 million.

Big Cities Rely More on Apartment Rentals

Dense and high-cost metro areas tend to have a much higher share of apartment rentals.

In New York City, 69.1% of rentals are in large multifamily buildings, the highest share among major U.S. metros. Minneapolis, Seattle, Miami, and Boston also rely heavily on large apartment buildings.

On the other end of the spectrum, cities like Virginia Beach, Cincinnati, Detroit, and Riverside, California have much lower shares of multifamily rentals and a larger presence of single-family rental homes.

Where Single-Family Rentals Are Still Common

Some metro areas continue to rely heavily on single-family rentals:

- Riverside, CA – 49.5%

- Nassau County, NY – 45.7%

- Detroit – 45.1%

- Sacramento, CA – 41%

- Las Vegas – 38.9%

These markets often have more suburban development and lower density, making single-family rentals more common.

Multifamily Rentals Have Grown Fastest in the Sunbelt

Over the past decade, several metro areas have seen major growth in apartment rentals. Dallas leads the list, with the share of rentals in large apartment buildings jumping more than 17 percentage points since 2014.

Other metros with large increases include Phoenix, Seattle, Atlanta, and Jacksonville. No major metro saw a meaningful decline in multifamily rental share during that period.

Single-Family Rentals Continue to Decline

Only two large metro areas saw a slight increase in single-family rental share over the past 10 years. Most others experienced sharp declines, especially in fast-growing Sunbelt markets like Phoenix, Charlotte, Tampa, Orlando, and Seattle.

Bottom Line

Renters are moving toward apartments because they offer more affordability, more availability, and more flexibility. With single-family homes locked up by owners who don’t want to give up low mortgage rates, apartments have become the primary option for renters trying to manage rising housing costs. As long as affordability remains a challenge, large multifamily buildings are likely to stay at the center of the rental market. For direct financing consultations or mortgage options for you visit 👉 Nadlan Capital Group.

Responses