Members of tax collectors of our sons: If there is a property registered under the first name of 2 ...

Ahlan, friends

Tax collectors of our children:

If there is a property registered in the first name of 2 people (not on the LLC), but the income earned by the property is entered only into the private account of one of them.

Will they both need an ITIN and both will have to report tax or just the one to which the profits are coming into?

The original responses to the post can be read at the bottom of the current post page on the site or in the link to a post on Facebook and of course you are invited to join the discussion

Once the property is registered on 2 private individuals, each of them should report its relative income according to the division between you. Not always this half and half, can also be 60 / 40.

Everyone should take ITIN and report. It does not matter where the rental money is transferred to, here it's already your business.

You asked a few questions and separated:

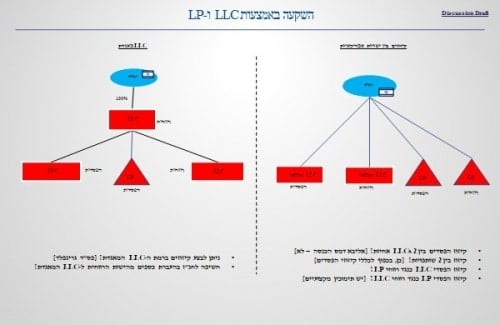

Revenue associated with an LLC is required to be entered into an LLC bank account rather than a personal account of one of the partners. There is no problem with transferring to the LLC account for the distribution of funds to the partners.

Each Partner / Member of the LLC must have a tax ID ITIN / SSN / EIN

They both report tax as long as the contract between them, Operating Agreement, holds otherwise.

Successfully