Waiting for the next housing crash?

Buyers of apartments: the housing collapse is not coming?

In 2000, the average apartment price was $ 126,000.

By 2020, the average apartment price had risen to $ 259,000, a 106 percent growth that occurred in less than a generation. What is amazing about this rise in apartment prices is how quickly the market recovered after the housing collapse in 2008.

Many contemporary homebuyers have reached adulthood during the Great Recession and they remember how difficult it was to find work and their parents to sell their homes.

The life experience of living in a housing collapse pushes some people to wait with the purchase. The housing market is rising and falling, and some people want to take advantage of the next housing bubble to enter the market at a more affordable price. However, they may wait a long time. The market is far from experimenting with repair and some housing costs will continue to rise higher than ever. Here are some reasons why housing demand will continue to rise and keep apartment prices high.

America is shorter than 5 million homes

Like any housing market that operates according to the basic economic rules of supply and demand. When supply is low and demand is high, apartment prices are rising. In 2008, supply was high because houses were foreclosed on and demand was low because no one could afford it. This caused housing prices to fall.

Currently, there is a significant shortage of supply, caused by many factors. First, home construction has been going at the slowest pace for decades. In 2012, 12.3 million homes were built. In 2021 there were only seven million. Problems in the supply chain and the epidemic prevented the construction of new homes, and limited the number of homes available.

New construction is not the only reason supply is low. NPR's Planet Money podcast explained that older Americans stay in their homes longer. They are able to remain independent and healthy, and allow them to live alone. In previous generations, these Americans moved into sheltered housing or moved in with their children, creating a turnover in the housing market. Without these homes reaching the market, the supply of existing homes remains low.

There are a number of factors that contribute to supply and demand in the housing market. However, they all point to the same conclusion: There are not enough homes available for the people who want to buy them. As a result, apartment prices remained high.

The housing market is not a statue

While the real estate market is certainly affected by national trends, not every market responds in the same way. Even if the collapse of the housing market was imminent, there is no guarantee that the neighborhood or city you want will be reasonably priced. Cities like Nashville, Tampa and Austin are considered high-growth areas, with more people moving there than the national average. A housing crash may cause a small drop in prices, but supply and demand will preserve home values.

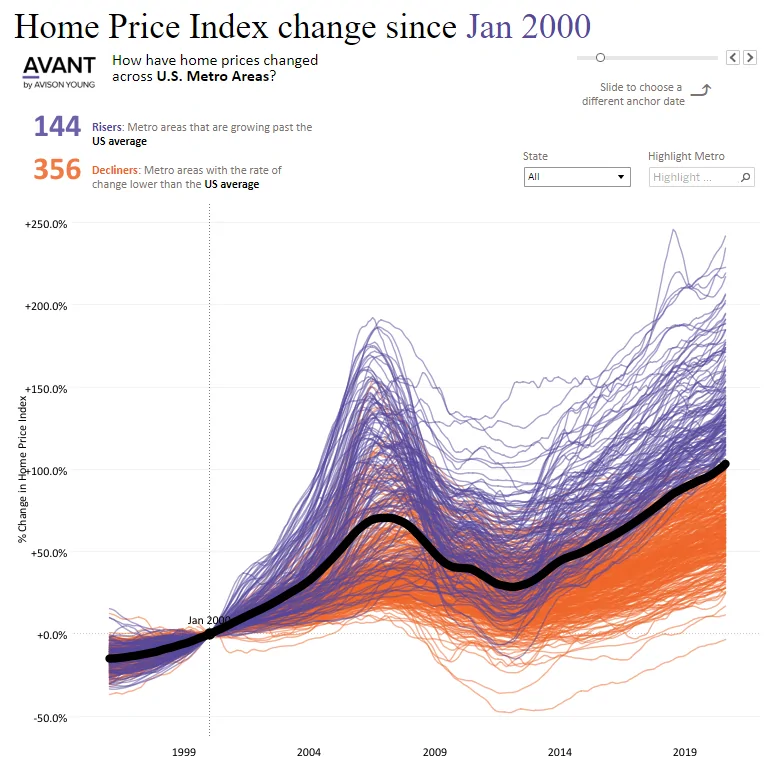

The Virtual Capitalist Home Price Index chart shows how demand for different markets varies from the national average. In San Jose, California, the average apartment price has risen by 227 percent since 2000. In Springfield, Ohio, the average apartment price has risen by only 25 percent in that period.

While the 2008 market crash shocked home sales across the country, it is unlikely that another housing bubble explosion could have the same impact across the country. Even in 2008, some markets were hit harder than others.

Climate change will affect where people live

Even within cities, there are social and economic changes affecting the cost of housing. The city of New Orleans is a prime example of this. The city is constantly hit by hurricanes while rising sea levels are increasingly causing flooding in neighborhoods that previously remained dry during storms. As a result, living near water becomes less desirable as the chances of property damage increase. It is also less lucrative because of home insurance and flood insurance costs.

Due to climate change, more people are moving to neighborhoods that are higher in the city, which is raising apartment prices in those areas while the apartment values of properties in low-lying areas are declining. There are similar traffic patterns in other parts of the country, where demand varies according to the area of floods. Other natural disasters are also changing the housing market. In California, shoppers are moving to areas that are less likely to experience fires, which is changing the demand in different towns and cities.

Mother Nature will beat any market trend caused by a housing bubble burst. In the end, the most lucrative homes will most likely be the low-risk homes.

You can not count on a housing crash

Some buyers have decided to wait for the next housing crash to enter the market. They believe that a crash in the coming years will create a large supply of homes and allow them to invest in the property at a more affordable price. However, the collapse of the housing market is not guaranteed, and it may leave you worse off financially.

First, apartment prices continue to rise. Buying a few years ago may help you save money instead of waiting until now or in a few years. Along with apartment prices, interest rates also fluctuate and may rise in the future, raising the cost of buying the property.

Moreover, the longer you choose to rent, the less time you have to build your equity. The money paid to a homeowner could go to your financial growth and long-term investments through a mortgage.

Finally, the 2008 housing crash was part of a traumatic economic event for millions of Americans. There is no guarantee that a housing crash will not bring unemployment and pressure on your finances. You may not have the financing to invest in a home if the collapse comes.

Start planning your real estate journey

Although it is important to study economic trends in your area, you should not put your life on hold because of a theoretical crash that may not come. Hope for a market crash can not replace strategic financial planning.

Take the first steps today to invest in your future and find your home.

Responses