What is a personal credit profile?

# Initiated week

# Post 2

What is a personal credit profile?

Like most immigrants who came to the US (and also most Americans, as you have discovered over the years) I realized that I had no idea about credit and moreover I thought that credit was a negative/dangerous thing and that it was not good to use money that is not mine.

In this post we will talk about what a personal credit profile is and important highlights for building and maintaining a good profile.

Let's start what is credit and why is it so important to us?

Our credit (credit rating) is a central component of our private and business lives here in the US.

Our credit rating is an indication of our financial reliability in the eyes of banks, credit companies, and other lenders, and has a major impact on our ability to receive loans, preferential interest rates, and other financial options such as mortgages, car leasing, and business credit and more...

Our credit profile consists of several criteria. The main ones are:

Our payment history - Payment History

Utilization of the credit limit - Utilization

Average age of CC - Average age of CC

How much new credit did we request - New accounts

And the variety of credit we have (from credit cards to loans) - Credit mix

All of these affect our rating and financial image and build our credit profile.

Who creates your credit profile?

There are over 50 different entities (credit bureaus) that buy and sell your financial information to produce your credit profile and score, which is checked by the various lenders every time you apply for a financial product. Out of all these bodies there are three central bodies with which you will always want to check your credit profile and they are:

Experian, TransUnion, Equifax

A little tip - never be late in paying your credit, not even accidentally

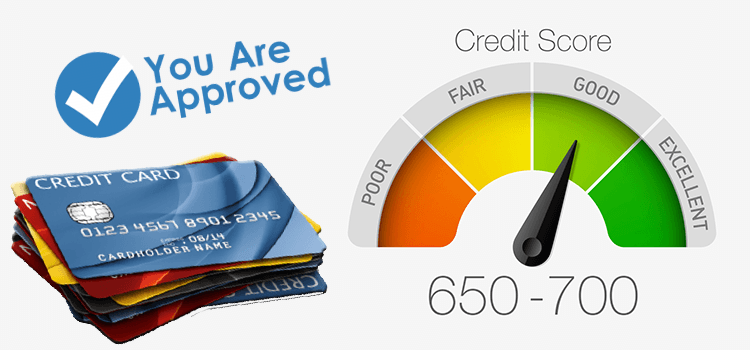

So what is good credit?

Everyone thinks that our credit score is the most important, and whoever has a score of 800 has the best credit.

So that's not it.

Credit is not just a number, and the credit score consists of calculating economic data plus the other elements of our credit profile (as I highlighted above). In other words, the score is a derivative of the strength of our credit profile. The important question to ask is not how much our score is but what our profile consists of.

What does an ideal credit profile look like?

Loans: 1-2 loans with a perfect payment history (open loans are better, when at least 80% of them are paid, but not in full.) This shows that you manage debts responsibly.

Personal credit cards: between 4 and 5 open credit cards, with a limit of at least $10,000 on one of them. This creates an image of responsible credit management and the readiness of banks and credit companies to give you money.

Credit utilization (Utilization): A utilization lower than 10% shows that you are using your credit in a healthy way and are not overly reliant on debt.

Our variety of credit (credit mix): We want to show a different variety of credit and that we work with several different credit companies and banks.

The average age of credit we have: We would like to maintain a minimum age of all our credit cards of two years or older (Average Age)

Another important tip - don't close credit cards, one of the most common mistakes people make is to close cards and think it's good that they closed because of the argument that: "It's not good to have too many cards"...

Sometimes the reason we want to close the card is because of the annual fee,

In such a case it is better to downgrade to a card without an annual fee, that way we didn't close our card (account) and we didn't damage our annual average and we preserved the history that this card built for us over the years.

(*of course there are special cases that require us to close but each case individually)..

Building credit is a process that takes time and a long-term plan.

Before you go to take out another credit/loan/listen to your friend's advice... it is important to understand what our goals are, for example:

Credit to get a loan/loan?

Credit for a car loan?

Credit for a business loan/credit?

According to the goals we will build the plan and set the goals.

I hope I was able to update you on a few things about your personal credit profile, in the next post we will dive into the credit profile of your business.

Responses