What the banks want to hear.

#יםמהשבווי Dean Live

# Post 4

* What the banks want to hear.

I will start this post with a question-

Who here was not enthusiastic from the moment he decided to buy real estate

in the US?

Whether you kept the news to yourself or you told your close friends, family, or a guy from the explosion... I'm sure that when you talked about it you had a little pride (because you deserve it!) and announced that I'm opening a real estate investment company. The only mistake was that you also told your banker...oops.

Before I begin to explain the source of the error, I will first emphasize an important detail - building a relationship with the bank:

One of our main goals in opening a bank account is to start building a good relationship with our bank.

what do I mean?

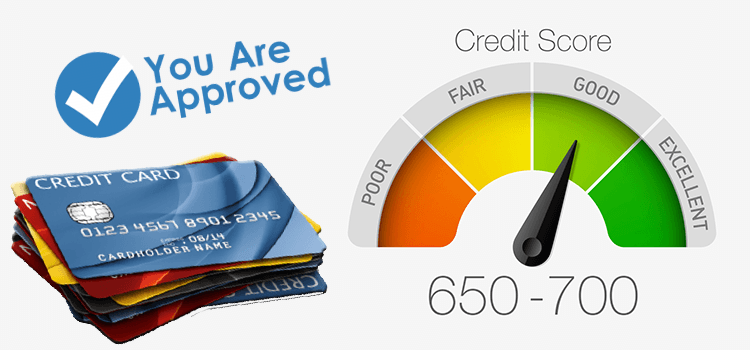

Every good relationship is built on trust. And for the bank, trust = perfection of data and level of risk.

The longer your bank account at a particular bank is open, the longer you flow funds into the account, show a positive financial history and demonstrate correct financial conduct, the more the bank's trust in you increases and the risk level decreases.

The bank's level of trust in you is expressed in the level of your priority over other customers in the bank and the amount of money the bank will be willing to give you (when you ask).

Now you are probably asking yourself - if opening a bank account is an important thing, and showing that I put money into the account and manage my finances correctly is essential, where is the mistake and how is my banker related?

To understand the mistake let's take a step back and remember one of our first steps before going to the bank to open an account.

So what did we do? We started a company.

And what was the first step before we opened it?

We chose a name for her.

And how many of you started a company with a name that indicates that their company is a real estate investment company or a construction company?

You're not alone.

Choosing the name is an important step, not to say strategic to some extent. With this name we are going to open a bank account, and most of us the banker asks what kind of company we have and we straight away proudly tell him that we opened a real estate investment company in America, or a construction company that does renovations... As soon as the banker realized what type of company we opened, he tags us in the bank to the same category The company we opened is related, and one of the things he associates with it is NAICS CODE. This code is actually the one that defines the field that our company deals in and defines its risk level.

It is important to understand - there are codes whose level of risk is lower and those which are higher.

Therefore, one of the important things to remember when we open a company and a bank account is to do it in a smart and planned way according to our goals and objectives to avoid putting a stick in our wheels.

And when it comes to choosing a name for a company that deals in an industry defined by the bank as having a higher level of risk (such as real estate and construction), it is better to choose names for a company with a lower level of risk such as Management or Consulting, or a name that does not at all indicate a specific field such as Avocado LLC.

In addition to choosing the name of the company, part of the strategic planning we do to pave a faster way to financial products with high funding includes the plan to open different bank accounts, or as I emphasized at the beginning of the post - building a good relationship with the banks.

Important tip - according to your goals and objectives in the program, you will choose one central bank from which you will manage most of the money of your business and in addition, you will choose a few more banks where you will open bank accounts and also develop a secure financial profile with them. In this way, when the time comes when you want to request credit or a loan from the banks, your relationship with the banks (the banks' trust in you) has already been built in advance, and your priority level and the amount of money the bank will be willing to give you will be higher.

*Of course, every opening of a bank account in a certain bank is done with strategic planning in order to achieve our goals. Just opening a lot of random bank accounts to say you opened and have a lot of accounts will not get you anywhere.

So, it is important to remember, when we intend to carry out business activities and obtain financing, the bank's perception of us and our business plays a decisive role. Banks have many criteria for measuring risk level, therefore building good relationships with banks is part of the door to success in obtaining high financing, without too many headaches, paperwork, long waiting times and putting our personal assets at risk (collateral).

Make sure over a longer period of time to show the bank that you are not a risk and build a positive financial history, so it will be easier for you to get financing and influence the amount of money the bank is willing to lend.

It is important to be aware that every action we take with the bank sends messages about our financial risk.

*The information in this post does not constitute professional financial advice or an accountant's opinion*

Responses